Cash flow management is essential to running a successful business. This is true for a number of reasons. Some of the reasons are obvious, and some are more subtle.

5 Steps to Building a Cash Pool for Better Cash Flow Management

First, you need to understand exactly what cash flow is. Investopedia says:

“Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business.”

But what does that mean practically for your business? Basically, cash flow relates to the actual, liquid cash flowing in and out of your business. Strong, positive cash flow allows you to have the funds you need ready and available. You can use them at any given time to do the things you need to do to run your business effectively and efficiently. Why is this important? Because you need cash to:

- Pay the bills

- Pay salaries

- Buy supplies and stock

- To be able to take advantage of growth opportunities

None of these things are possible without cash. You need a cash flow management strategy.

Step 1: Understand Profit is Not the Same as Cash

This is one of the most common misconceptions when it comes to cash flow management. Many think if you have a strong bottom line, you have cash. Some business owners are surprised when they find their business can be doing quite well, but they still struggle to pay the bills. This is because sales do not automatically convert to cash.

It can take time to collect payments from customers. Also, if you run a seasonal business, certain times of the year are going to find your business shorter on cash than others. Even non-seasonal businesses have times when they aren’t making as much money.

Step 2: Knowing Why Just Enough is Not Enough

It’s possible that you may have all the cash you need for day to day business operations, but you still need more. For example, if you have an investment opportunity, like a bulk wholesale deal on inventory, or a growth opportunity, you need to be able to act fast. The more cash you have immediately available, the faster you can act on these opportunities with confidence.

A sensible cash flow management system will take this into account.

Step 3: Develop a Plan for Building a Cash Pool for Cash Flow Management

A cash pool can help you manage your cash flow effectively. It’s a way to make sure you have access to the cash you need, when you need it. A cash pool is an aggregate collection of three different types of cash.

It includes cash on hand, cash available to spend on vendor accounts, and cash available to spend on business credit cards. How do you build a cash pool for your business? How do you do so and keep business expenses off your personal credit accounts? You need to build business credit. Using business credit to build a cash pool is key to cash flow management.

Cash Reserves and Vendor Accounts

Cash reserve is simply cash on hand. This is the money you have in your business bank accounts that you can spend. Vendor accounts are accounts that you have with vendors that allow your purchases on credit. These are typically net accounts rather than revolving. Net accounts have to be paid off completely within 30, 60, or 90 days, depending on what terms you get with that lender.

Cash Available on Business Credit Cards

This is the total of all available credit you have on business credit cards. Business credit cards can serve your business well in a number of ways. First, they can help protect your business by limiting exposure when making purchases online. This is because most credit card companies have fraud protocols. These protect you from having to pay for fraudulent charges on your account.

In contrast, if you use a debit card connected to your business bank account and it gets hacked, you could easily lose all of your available cash with potentially very few options for recovery.

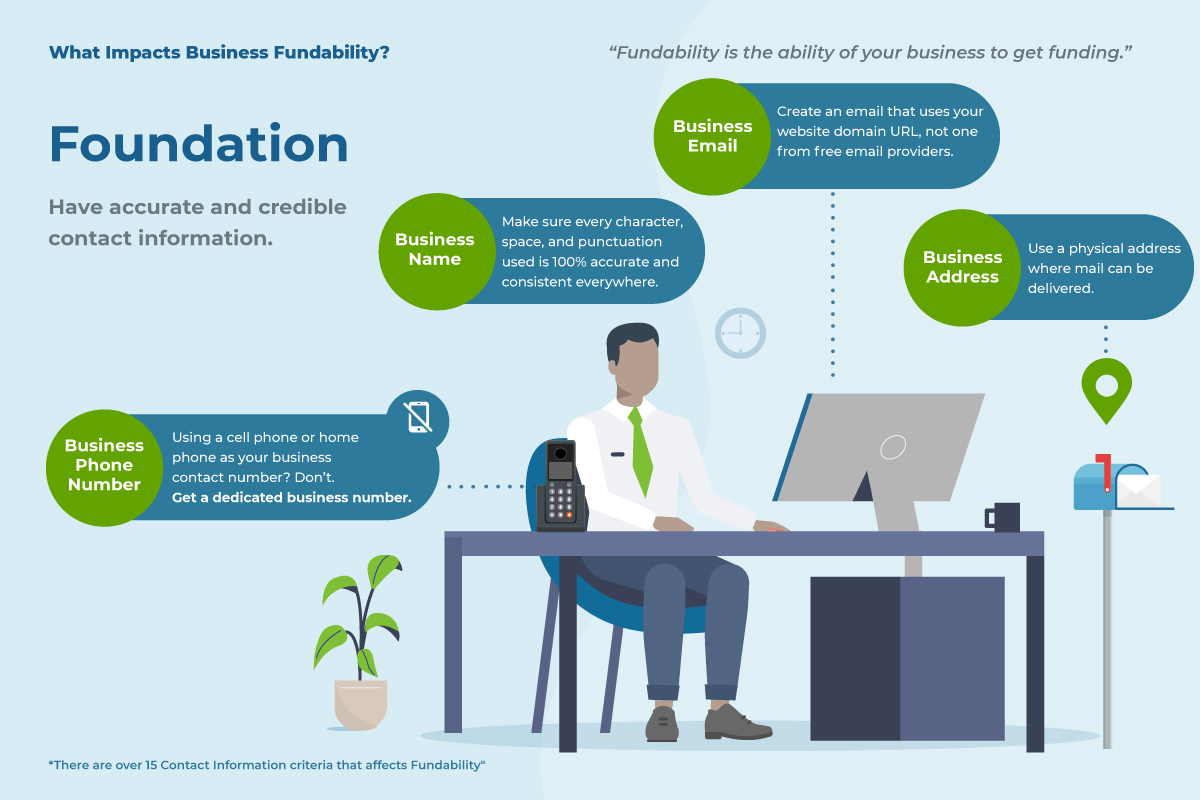

Step 4: Start the Process by Building a Fundability Foundation™

It sounds easy, and essentially it is. However, you can’t just go out and apply for vendor accounts and business credit cards and expect to get credit that is only related to your business and does not affect your personal credit report.

It sounds easy, and essentially it is. However, you can’t just go out and apply for vendor accounts and business credit cards and expect to get credit that is only related to your business and does not affect your personal credit report.

This is the tricky part. There are specific steps that you have to take in a specific order to build a separate business credit profile and score. It starts with how your business is set up. It has to have a foundation of Fundability. Then, you have to get accounts reporting initially, which can get interesting.

If your business isn’t set up right and you don’t apply for the right types of accounts in the beginning, you will be denied every time.

How to Build a Fundability Foundation™

The first step is to make sure your business has a fundable foundation. The includes a number of things such as:

- Having a physical business address where you get mail

- A P.O. Box or something similar will not work

- You need to incorporate as an LLC, S-corp, or corporation

- An EIN is essential (get yours from the IRS)

- A D-U-N-S number from Dun & Bradstreet

- You need a separate, dedicated business bank account

This is only the beginning, but it is a good start.

5: Get Accounts That Report

Once you have a fundable foundation, you can start applying for business accounts. The key is, you have to start small by applying with starter vendors first. These are vendors that will not do a personal or business credit check. Rather, they will extend net terms to your business based on other factors.

These factors may include:

- Time in business

- Revenue

- Average balance in business bank account

- And a lot of other things

Vendors may look at one, all, or any combination of these factors to verify the creditworthiness of your business. Then, they will report your payment on these accounts to the business credit reporting agencies.

This brings up another issue. Unlike personal credit accounts where pretty much all creditors report your payment to your personal credit profile, only about 7% of business credit accounts actually report payments. Of course, the other 93% will not hesitate to report defaulting payments.

As a result, it can be difficult to find vendors that will both extend credit without a credit check and report payments. They do not make this information easy to find. Still, having accounts that report is vital to building a strong business credit score. Without that, you will not be able to get the accounts you need to build your cash flow pool.

Getting Started

We have a list of vendors that we know do both of these things. They include vendors like Uline and Grainger, among many more. Start building your credit pool with these and other starter vendors by applying for accounts, and buy things like packaging, cleaning products, and office supplies that you will use in the course of your business anyway.

Once you get enough of these accounts reporting, you will be able to apply for more vendor accounts and business credit cards and get approval.

Of course, you need more than just a few vendor accounts to build a strong business credit score. The next steps include applying for credit with increasingly harder to meet requirements. If you do things in the right order, you will have no problem getting approval. That is, assuming you handle all accounts responsibly.

You can apply for accounts that are a little harder to get, but apply with starter vendors first. That way, you’ll be closer to meeting their requirements.

Keep the Ball Rolling

After that, you just have to keep the ball rolling. You should be well on your way to building your cash flow pool. You can apply for higher limit cards with more rewards. Remember to keep using all of your accounts responsibly, as It does no good to build a cash flow pool if you have no cash available on any of your accounts.

Bonus: A Top Secret Tip to Help You Get Started

It is not easy to start the ball rolling on your own. It is much faster, cheaper, and easier in the long run to get expert help to build your cash flow pool. A business credit expert can help you evaluate your current fundability. Then, they can get you on the right path to building and improving fundability if necessary. Furthermore, they can point you toward those initial business credit accounts that will open the door to many more,

With a business credit expert, you will not waste time applying for accounts you do not qualify for. You won’t waste time and money on accounts that do not report to the business credit reporting agencies. You will know exactly what step you are on and what needs to be done to move on to the next step in the process, so you can build your cash flow pool effectively and efficiently.

Once your business credit is strong, a business credit expert can guide you toward even more accounts that may be great additions to your specific credit pool. These may not be accounts that report, but rather may be more suitable for the type of business you run. Once your business credit profile is strong, you can use non-reporting accounts to continue to grow your business long into the future.

What Does This Mean for Cash Flow Management?

It means you can run your business without worrying about cash flow gaps. You can take advantage of wholesale deals when they come along. It will be possible to apply for larger jobs, knowing you can get the tools and equipment you need to get the job done without depleting cash reserves.

You will be able to quickly take advantage of investment and growth opportunities with confidence, knowing you have the cash available to do what you need to do. In addition, you can limit your exposure to fraudulent charges when making online purchases. That is sensible cash flow management.