How to Build Business Credit: The Unparalleled Guide

Build your business’s credit from scratch and unlock “EIN only” business financing with no personal guarantee.

We consulted the top business credit industry experts and (for the first time) revealed our unique business credit industry research.

This is the most cutting-edge business credit guide on the planet. We’ve seen people get top-notch business credit scores in less than 90 days following these steps - and unlock powerful financing for their business in record time!

1. Create a Separate Business Entity

Business credit issuers look for basic signs of legitimacy when assessing applications. If your credit history is limited, these fundamental indicators tend to have even more impact on your Fundability.

Our industry research discovered over 125 factors to consider! But here are some of the most critical ones to address.

"

There are over 125 factors that we found that tie into your fundability. Set up your business to be structured so that you look credible. When you’re filling out an application for credit or financing, every line item on the application needs to make you look credible.

80% of financing applications are denied because your business details don’t match up, not because you don’t meet the lender’s qualifications.

Ty Crandall

Credit Suite CEO

Business License

A business license proves your company is operating in compliance with local regulations.

Registering your business entity with your state can be similarly beneficial. Sole proprietors and partnerships have less financing options available to them. Some lenders only lend to entities like LLCs, S-Corps, and C-Corps.

Business Address

Stay away from P.O. boxes and UPS addresses. A genuine retail location or virtual office is ideal, but you can also use your home address as a last resort.

Business Phone Number

Avoid using a mobile phone or a home phone number for your business. Instead, consider using a VoIP service like Google Voice or a virtual phone number app like Dialpad.

Phone Number Listed With 411

If your business has a landline, your local phone company should add the number to 411 directories for you. If not, you can use services like List Yourself or Local Listings to initiate the process.

Business Website

In 2025, a functional business website is all but required to anchor your digital presence. It doesn’t have to be fancy. But it should be professional, branded, and contain your business’s contact information.

Business Email Address

Instead of a generic Gmail, AOL, or Yahoo account, use an email address that ends in your website’s domain name. For example, if your website were SampleBusiness.com, your email address should look like [email protected].

2. Get an EIN

An Employer Identification Number (EIN) is like a Social Security number (SSN) for your business. You can use it to apply for credit with your company’s identity, helping you establish its credit history—and potentially protecting your personal credit score.

If you operate as a limited liability company or corporation, you should get an EIN before you form your legal entity. You can request one for free using the Internal Revenue Service’s (IRS) online portal.

It should only take a few minutes to complete the process, after which you should receive your EIN instantly if approved.

3. Get a DUNS Number

A DUNS number is a unique nine-digit number that identifies your business in the Dun & Bradstreet (D&B) database. D&B is one of the three major business credit bureaus, alongside Equifax Business and Experian Business.

Getting a DUNS number helps kickstart the opening of your D&B business credit report. In addition, lenders and vendors will often ask for one when you apply for credit.

You can apply for a DUNS number for free through D&B’s online portal. However, you may have to wait up to 30 business days to receive your number. If you pay for expedited service, you can get it within eight days.

"

It’s not unusual for businesses that have been around for years to discover they have no business credit history.

Most business owners don’t think about business credit until they need it, or it causes some kind of problem for their business. Some business owners figure they don’t need to build business credit unless they want to get financing.

But just like a good personal credit history makes it easier to get a cell phone plan, rent an apartment, or more, strong business credit scores can impact your business in ways that go beyond borrowing.

Gerri Detweiler

co-author of Finance Your Own Business: Get on the Financing Fast Track

4. Open a Business Bank Account

A separate bank account is another sign that your company is legitimate. we see that lenders may check whether yours is in good standing as part of their due diligence. Certain business credit scores ding you for not having one.

Even when that isn’t the case, simply having a business bank account is a common qualification requirement, especially with alternative credit providers. They often use bank account activity to help inform their underwriting.

A separate bank account is also invaluable for bookkeeping, making it easy to distinguish between personal and business expenses.

If you have trouble qualifying, consider using SIC codes that banks like. You can also pursue a second chance business checking account, which should have less rigorous requirements.

5. Open Vendor Tradelines

Also known as trade credit, vendor tradelines are credit accounts from merchants you do business with rather than lenders. They’re usually easier to get, especially as a new small business owner. In our experience, getting vendor tradelines is the most time-consuming part of building business credit.

They often have limited use cases outside of building credit. Many of the most popular vendor tradelines are net 30 accounts with supply companies, like Uline or Grainger Industrial Supply.

Opening vendor tradelines is the first real step toward creditworthiness, as they form the basis of your business credit history. Your business credit report primarily details how many you have, how long they’ve been open, and how you’ve used them.

The best vendors to build business credit share their data with each major business credit reporting agency, helping you get a strong credit score with each one.

"

The most underutilized goldmine in business financing is leveraged vendor credit programs – where your suppliers essentially become your 0% interest lenders. Here's why this dominates traditional financing:

1. Immediate Access. You get net-30/60/90 terms with $5K-$50K lines from suppliers like Uline, Quill, and Grainger. There are no personal credit checks or revenue requirements at approval.

2. Credit Stacking Potential. Each approved vendor adds a new trade line to your D&B file. We’ve seen clients build $250K+ in combined vendor limits within 6 months.

For example, my bakery client used $18K in flour/sugar vendor credit to fulfill a wholesale contract 3x their normal capacity, and repaid from profits after delivery.

Dr. Stephanie Ardrey

JD, DBA, President/Broker, Blu Diamond Capital

6. Open a Business Credit Card

While not required, business credit cards can be powerful tools for building strong business credit. They’re financial tradelines—like a business loan or other traditional credit line—so they tend to be more impactful to your business credit profile than vendor tradelines.

They also tend to be more broadly usable, offer more flexible payment terms, and have a higher credit limit, making them useful for managing cash flow.

If you have a strong personal credit history, you can often qualify for a business credit card without a good business credit score. However, that usually means signing a personal guarantee, which makes you personally liable for the credit account.

Once your business credit is better established, you can apply for EIN only business credit cards that don’t require a personal guarantee.

7. Make On-Time or Early Payments

Unlike the personal credit market, where FICO dominates, no single scoring model defines business credit. As a result, business credit scores tend to differ more widely than personal credit scores in multiple ways.

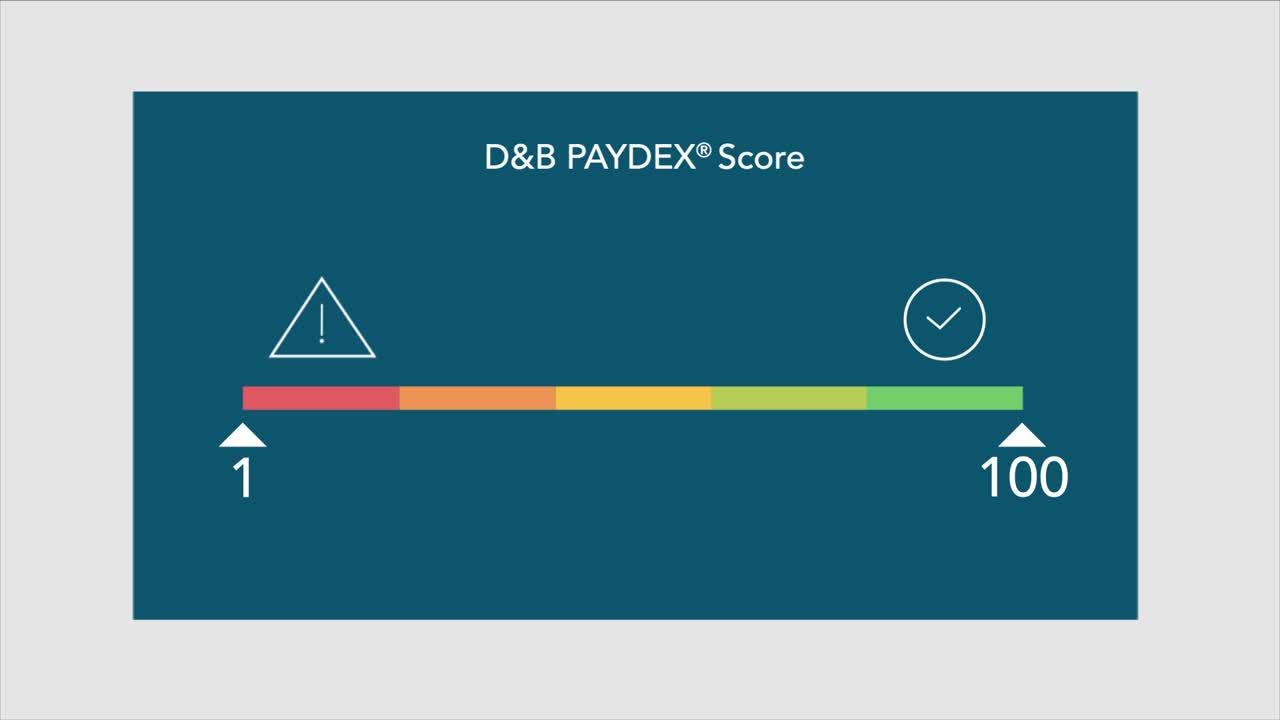

For example, D&B’s PAYDEX Score ranges from 1 to 100 and is skewed highly towards your average payment timeliness. For a perfect rating, you must consistently make payments 30 days before they’re due. Simply paying on time caps your score at 80.

Meanwhile, the FICO Small Business Scoring Service (SBSS) score ranges from 0 to 300. It also uses a more comprehensive set of factors, including credit utilization, to estimate how likely your business is to make timely payments.

Despite these differences, payment history remains the most impactful factor across nearly all business scoring models. How long you’ve been paying and the timeliness of your payments heavily influence your scores.

As a result, building business credit is primarily about opening multiple tradelines and making your payments on time—or early, to maximize your PAYDEX—until you have a well-established business credit history.

"

Business credit case study: One of our clients went from 0 to a 78 Paydex score and $250,000 in business credit lines in just 37 days – and no, they didn’t have perfect personal credit or existing revenue. Here’s the exact accelerated blueprint we used:

Week 1-2: Foundation Setup

-Form an LLC with registered agent

-Established a business bank account with $500 deposit

-Got a dedicated business phone (RingCentral)

Week 3: Starter Vendors

-Approved with 5 net-30 vendors (Uline, Quill, Summa Office, Grainger, Wise Business Plan)

-Placed small orders ($50-$100) and paid early

Week 4: Retail & Fleet Cards

-Approved for Dell Business Credit ($10K limit)

-Secured a Shell Fleet Card ($7,500 limit)

Week 5: Cash Credit & Scaling

-Approved for Brex Card ($25K limit)

-Qualified for Amex Business Platinum ($50K+)

The Secret? We used credit piggybacking by adding their business as an authorized user on aged corporate tradelines (legally), which turbocharged their credibility.

Warning: This requires military-grade precision – one mixed personal/business purchase can reset your timeline.

Dr. Stephanie Ardrey

JD, DBA, President/Broker, Blu Diamond Capital

8. Monitor Business Credit Reports and Scores

Building business credit is an ongoing process, not something you can set and forget. Even if your tradelines are open and your payments are automated, active engagement is necessary to keep things on track.

Business credit monitoring services are the best way to stay informed. In addition to providing regular access to your credit data, they should alert you whenever notable changes to your profile occur.

"

The most common mistake we see on business credit reports is incorrect address information.

Often, business owners will use their registered agent as their official business address. Afterwards, they will file with their state to change the address to their true business address. This does not update with the business credit bureaus, which often causes discrepancies across all their reports.

These discrepancies across addresses can lead to declines on credit applications, especially if they are automated, which most are.

Aaron Velazquez

CEO and Co-Founder of Business Credit Monitoring Service FairFigure

Common monitoring alerts might include:

- Drops in your score

- Late monthly payments

- New hard inquiries

These services can help you catch issues early, fine-tune your credit-building strategy, and stay motivated. Just be sure to pick one that monitors each major business credit bureau, as they may receive or report different information.

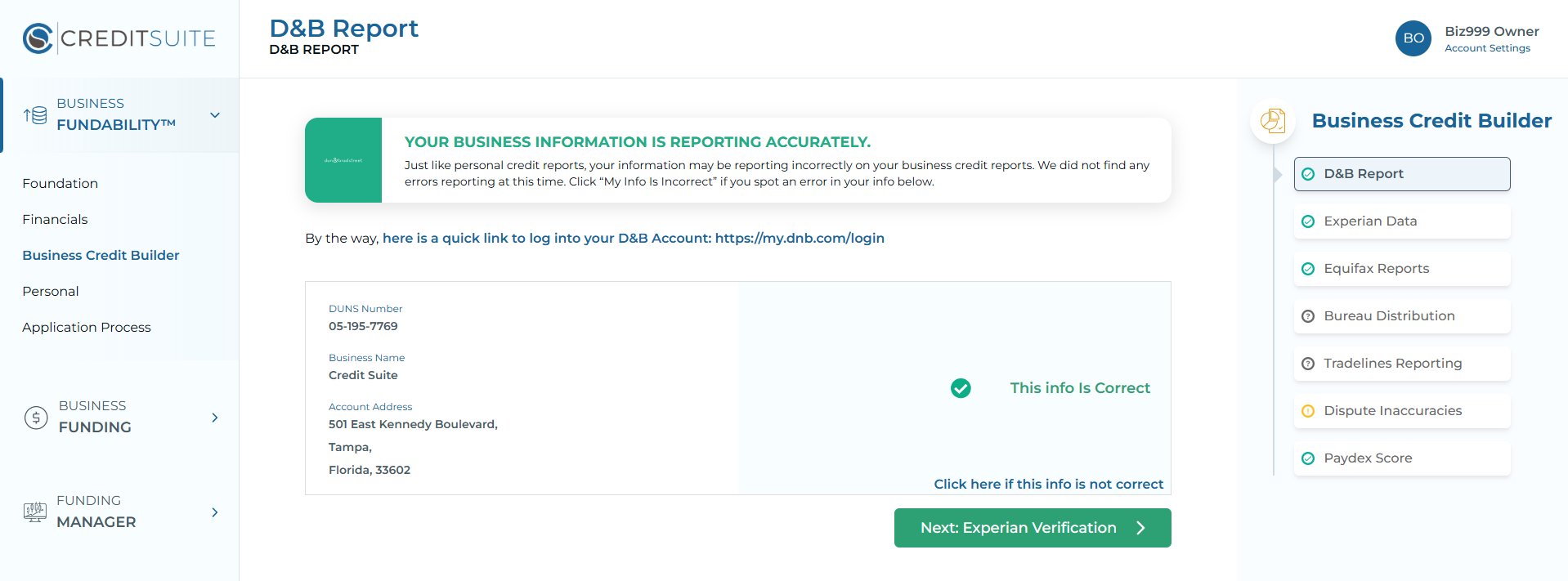

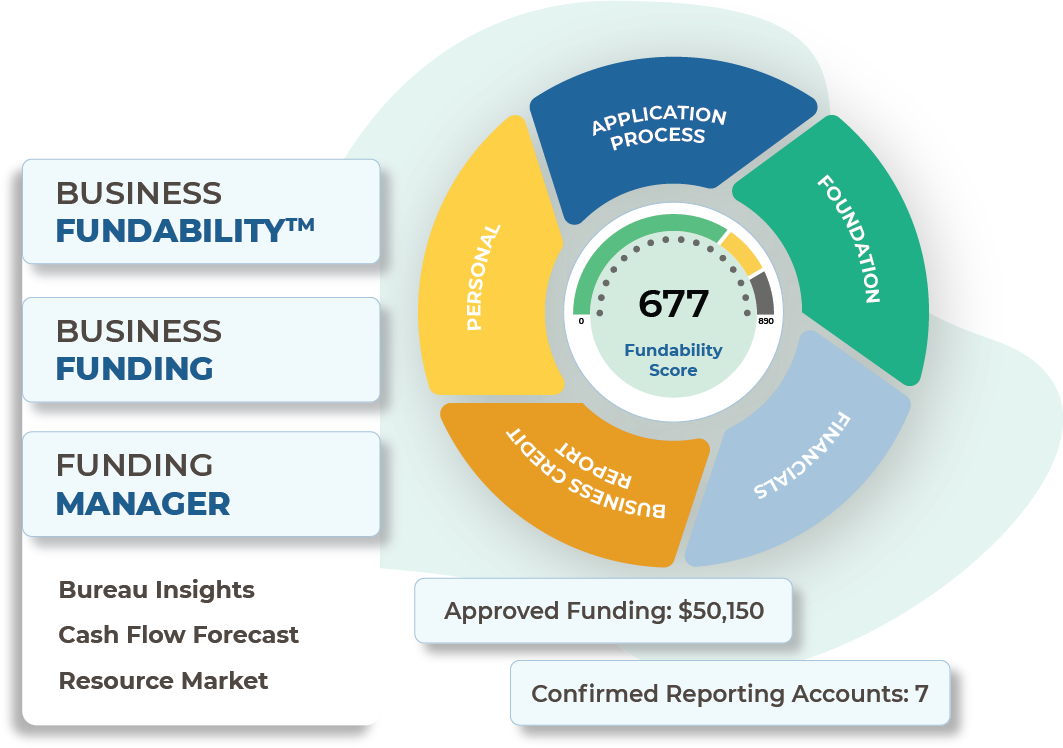

Want help with the credit-building process? Credit Suite’s business credit builder program provides step-by-step guidance, expert support, and powerful tools to fast-track your journey to a good credit score.

The Business Credit Builder

The Credit Suite Business Credit Builder and Business Finance Suite can help you with build business credit by doing the heavy lifting for you. We have a team dedicated to finding and maintaining hundreds of business credit accounts. The Business Finance Suite will help you understand and improve your Fundability, establish your business credit profile, get business credit accounts, and even give you direct access to lending opportunities.