Are you a small business owner looking for ways to manage cash flow? An Amazon Business Credit Line provides a great way to increase liquidity in your company while managing your ongoing operations.

For small business owners, fluctuating demand for inventory, supplies, or other unexpected expenses is commonplace and stressful.

This is where Amazon Business Credit Line comes in. Amazon offers a fast and easy way to purchase products now and pay later. This gives you flexibility and control over your business operations.

In this article, we’re going to cover the Amazon Business Credit Line program, the terms of this program, how to apply for and secure credit, and other financing alternatives.

What is an Amazon Business Credit Line?

Amazon Business Credit Line is a credit instrument offered by Amazon through its Pay-by-Invoice program. It allows business owners to buy products now and pay later at a set timeframe.

Some of Amazon Business Credit Line’s main features are itemized digital invoices, multiple buyer accounts, and enhanced reports for tracking spending patterns.

Application Requirements for Amazon Business Credit Line

Your account will be assessed for credit line approval once you open an Amazon Business account. Approvals are evaluated on a case-by-case basis but generally, Amazon is looking at the following:

- an Amazon Business account in good standing

- an address registered with Amazon

- at least one previous order placed with Amazon

- a good credit score

Rates for Amazon Business Credit Line

There are no annual fees or interest charges for the Amazon Business Credit Line offered through the Pay-By-Invoice program.

Repayment Terms for Amazon Business Line of Credit

The default repayment terms are 30 days for Amazon Business Duo and Amazon Essentials.

You can extend your repayment terms by enrolling in a higher-tier Business Prime Membership Plan. With a yearly membership, you can extend your base-level 30 days repayment terms to 45 days with Business Small or Medium or 60 days with Enterprise.

Keep in mind that Business Prime Membership is not free.

You can pay your invoices via an automated clearing house, wire transfer, or check.

Benefits of Amazon Business Credit Line

The Amazon Business Credit Line offers numerous benefits that can help you streamline your business dealings.

Firstly, it provides a great way to manage cash flow for business expenses and allocate budgets for specific purchases. You can set up multiple buyers on your business account and individually track their spending.

Moreover, the Amazon Business Credit Line gives you an easy way to generate, pay, and manage your invoices, offering a more efficient alternative to buying individual products. You can search and download invoices with specific information such as their PO, transaction amount, and date.

Additionally, with the help of the Amazon Business Analytics tool, you can reconcile invoices using specific reports.

This allows you to gain valuable insight into how you track your spending and manage your finances, ultimately leading to better decision-making for your business.

These benefits make Amazon Business Credit Line a great fit for new businesses, side hustles, or existing small or medium-sized businesses that are in need of a convenient and effective credit instrument.

How to Apply for Amazon Business Credit Line

Applying for an Amazon credit line through the Pay-By-Invoice program is very easy once you know how to do it. Here is the step-by-step process:

Step 1: Start an Amazon Business Prime Account

Go to the Amazon Business Signup page, select the plan that you would like to sign up for, and enter all the required information about your business.

Source: https://www.amazon.com/businessprime

Step 2: Select “Pay-By-Invoice” as a payment method

Go to your account settings and navigate to the “Payment Methods” page. Select “pay by invoice” as a payment method. Fill out the required information about your business to formally apply for the program.

Source: https://www.amazon.com

Step 3: Wait for Approval from Amazon Administration

Amazon will take a look at your application and get back to you about whether you have been accepted or not. Once you have been approved, you should receive a welcome email with a link to set up your Pay-by-Invoice account.

Other Amazon Financing Options

Amazon’s Business credit line offered through the pay-by-invoice program is a great financing option for businesses that buy Amazon products. However, there are some other financing options for Amazon sellers and other business needs.

Amazon’s Business credit line offered through the pay-by-invoice program is a great financing option for businesses that buy Amazon products. However, there are some other financing options for Amazon sellers and other business needs.

Amazon Business American Express Card

The Amazon Business American Express Credit Card gives Amazon customers another source of business credit. With features like 3% back on the first $120,000 in purchases/year and $0 annual fees, the Amazon Business credit card is a great option for businesses looking for operational flexibility.

Application Requirements

To apply for an Amazon credit card, go to the Amazon Business Card Page and click “Apply Now”.

You don’t have to be an Amazon Business member to apply for a business credit card. However, a business account gives you access to enhanced data views where you can see all your purchases laid out nicely.

If you are applying on behalf of a partnership or corporation, you will need to submit information about the beneficial owners.

Repayment Terms

You get a choice between earning 3% back in rewards or 60-day payment terms without a Prime membership. If you do have a Prime membership, you can get up to 90-day payment terms on U.S. purchases of Amazon products.

Amazon Lending

Amazon lending tools give Amazon sellers various financial instruments to secure funding and increase flexibility in their business operations. These products include term loans, interest-only loans, business lines of credit, and merchant cash advances.

Amazon lending tools give Amazon sellers various financial instruments to secure funding and increase flexibility in their business operations. These products include term loans, interest-only loans, business lines of credit, and merchant cash advances.

Application Requirements

- online application completed through Amazon Seller Central

- no credit check for smaller loan amounts

Rates

- Fixed rates for term loans, Interest only loans, and business lines of credit

- Fixed capital fee on future sales for merchant cash advances

Funding

- Up to $2 million in funding for small businesses

Repayment Terms

- Non-revolving, lump sum funding for Term Loan, Interest Only Loan, and Merchant Cash Advances

- Revolving credit for Business Lines of Credit

Best Alternatives to Amazon Business Credit Line

If Amazon Business Credit Line isn’t quite right for your business, there are some other great options you might want to take advantage of. When looking for good credit options, you want to make sure it has competitive rates, fast funding, good repayment terms, and simple application requirements.

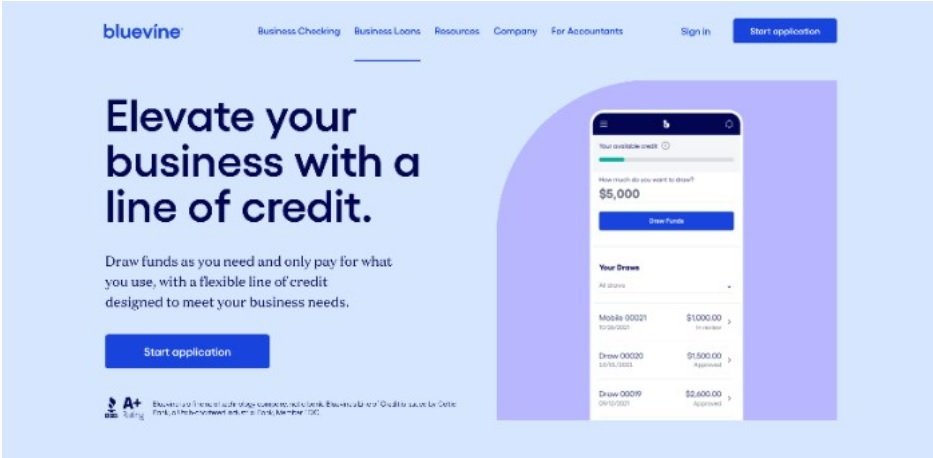

BlueVine

Source: https://www.bluevine.com/business-line-of-credit

BlueVine is a financial technology company that offers fast and flexible revolving lines of credit. This is a great alternative to Amazon’s Credit Line because of its 24-hour approval and funding turnaround.

Application Requirements

- You have to be in business for at least two years

- Established credit history and credit score of 625

- Minimum annual revenue of $480,000

Rates

- Annual Percentage Rate of 6.2% to 78%

Funding

- Easy online application where you can receive quick funding within one day (decisions made in as little as 5 minutes)

- up to 250,000 in working capital

- revolving credit line that replenishes as you spend

Repayment Terms

- 6 or 12 months

- Weekly or monthly repayments

Bottom Line

BlueVine is great for new and growing businesses that urgently need a line of credit. The company brags about giving you funds in 24 hours which is a hard timeline to beat for other business credit options.

OnDeck

Source: https://www.ondeck.com/business-line-of-credit

OnDeck is a financing company that works specifically with small businesses in the US.

Application Requirements

- 12 months in business

- minimum credit score of 625

- $100,000 in business annual revenue

Rates

- Average annual percentage rate of 48.9% (as low as 10.9% and as high as 100%)

Funding

- Loan amounts up to $100,000

- revolving credit line

Repayment Terms

- 12-month Repayment Term

- Weekly Payments

Bottom Line

OnDeck is a fast-funding line of credit option for small business owners and startups. Because you only need to be in business for 1 year and have annual revenue of $100,000 to be approved for a loan, it’s a no-brainer for companies needing liquidity ASAP when they don’t yet qualify for other options.

Summary

There you have it, if you buy lots of products on Amazon for your business and you’re looking for an easy way to streamline the process, Amazon Business Credit Line has got your back.

On the Amazon Pay-By-Invoice program, you can change your payment terms from net 30 to net 45 or net 60 by simply upgrading your Amazon business account. This kind of flexibility gives you the funding you need when you need it.

However, if this arrangement doesn’t quite meet your needs, you can also go with the Amazon Business American Express Card, Amazon lending program, or even one of the other alternatives.

At the end of the day, it’s important that you make the right choice for your business so be sure to compare the terms of each credit option before making your decision.