Start Your Application with Credit Key

Learn More About Credit Key & Credit Suite Before Applying

Terms & Conditions | Privacy Policy| Tax Hive Privacy Policy

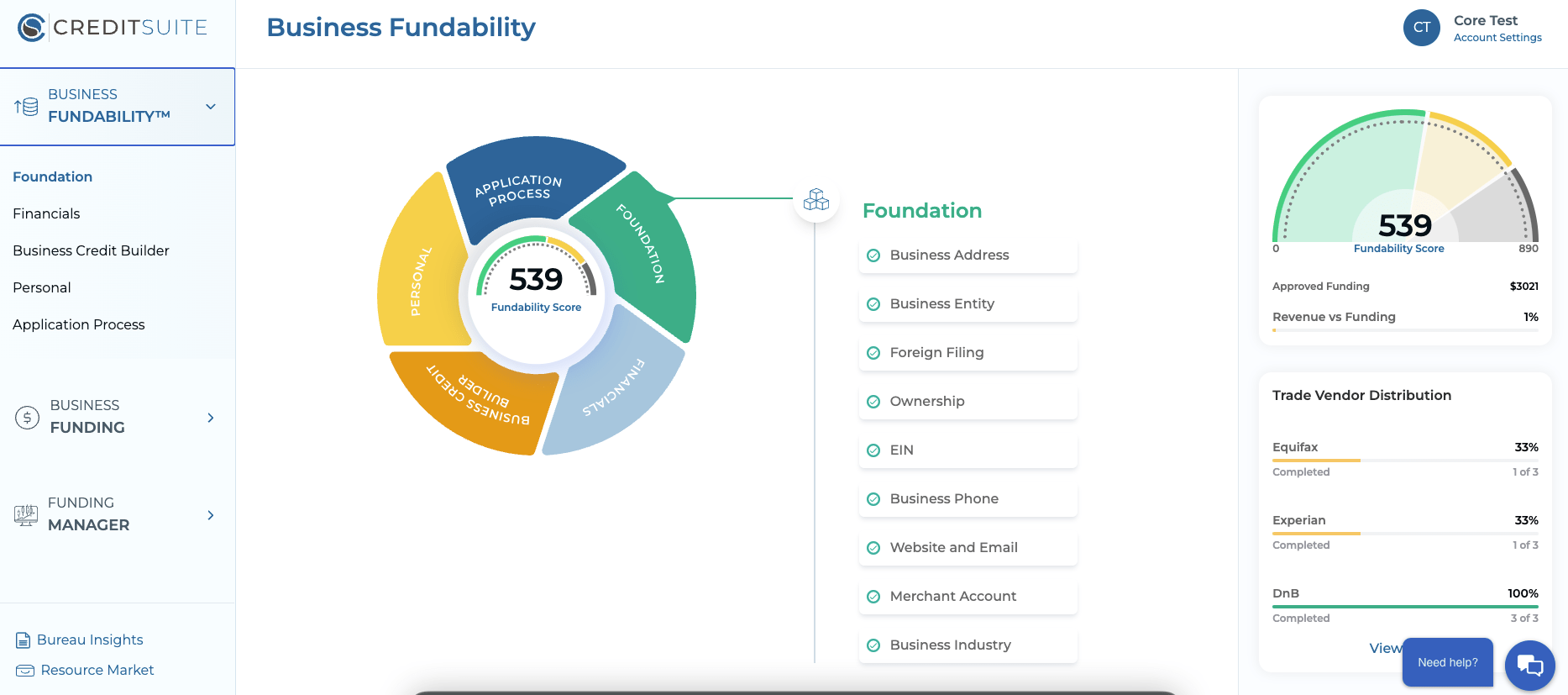

The Fundability System is the first of its kind—the one and only Fundability™ and Financing software that exists on the market today.

Our new, interactive Fundability System™ adapts to each and every business owner and their unique situation, responding intuitively to the answers you provide, generating a step-by-step, personalized funding plan to quickly build your business credit, apply for financing, and get approved for hundreds of thousands in business credit and loans … all in one place.

Through Fundability™, we give business owners like you the opportunity to SUCCEED in building their dream, growing their business, and having a real chance at lasting success.

It’s a proven, simple, easy-to-use system that’s helped nearly 50,000 business owners get the funding and credit they need for their business.

Plus … It works even if you’ve been in business for years or you’re just getting started.

Fundability™ is the fastest and easiest way you can ensure your business has ON-DEMAND access to loans, lines of credit, business credit cards and vendor accounts for the life of your business.

When you join, you’ll receive exclusive access to industry-leading Fundability™ technology to help you with all aspects of improving your Fundability, building your business credit, and getting loans and credit lines … so your business can THRIVE year after year, recession or not.

PLUS … you’re helped through the process step by step with your own Business Credit Advisors and Finance Specialists.

What Business Credit and Business Funding Is Really About … It's More Than Just Money … Much More …

Business credit and business funding means you can get money to:

There are hundreds of reasons to get business credit and business financing. But here’s what business credit and business financing is really about.

It’s about your goals … your future … your prosperity and being able to look after those you care about the most.

Who does this work for?

If you’re worried that you won’t know how to do it or that it won’t work for you? Relax. Our program is for anyone who wants to be (or already is) a business owner…

If you’re

The Fundability System™ can work for you.

Plus … we provide you with instant access to powerful resources you’ll need to be successful including: the option to add Concierge Coaching to your Fundability System™. That’s right … get UNLIMITED comprehensive, one-on-one coaching with our Business Credit Advisors and Finance Specialists, even access to ongoing tech support all for only $197/month.

1

Ditch the outdated videos, audio recordings and hours of cumbersome content that walks you through the business credit building process painfully step by step. Simply input your business’s information and gain complete access to the key Fundability Factors that unlock UNLIMITED funding opportunities every time you increase your business Fundability.

2

Funding a business with one loan or one credit card is nearly impossible. Any successful business owner in pursuit of growth, sustainability, and longevity will need ongoing access to capital for the life of their business.

3

Getting approved for one loan or one credit line, in many cases, prevents you from accessing any more credit and financing in the coming days, weeks or months. Having Fundability means having the power to access business credit and business financing at any point in your business journey … especially when you need it most.

4

Most companies in this space only offer business credit building or business financing alone—not both. For the ones that do, access to funding is limited. Whereas most lenders and brokers only offer 1, 2, or 3 funding programs, Credit Suite offers HUNDREDS of vendors and creditors to choose from to start or grow your business.

5

When you build business credit on your own, it can cost you THOUSANDS and take YEARS with little-to-no-results guaranteed. Our unique Fundability System takes years of business credit building and condenses it down to ONLY months.

6

Our expert Finance Specialists work closely with some of the nations top lenders and creditors. Out of thousands of sources, we know which ones do the best job, offer the best terms, lowest rates, and the highest quality customer service … so your experience is easy, fast and SECURE for greater peace of mind with every application approved. Plus … you’ll save you hundreds, even thousands in interest, year after year.

7

In less than 12 months, your business will have the ability to actually FUND ITSELF … so you’re no longer risking your retirement, dissolving all chances of buying a home, or getting so buried in personal debt that you can’t manage to cover unforeseen life events.

8

One of the main reasons that businesses fail to build business credit or get the loans and credit lines they're looking for is because they get stuck... Having experienced business credit coaches at your fingertips can keep the process moving even when it feels stuck. Your enrollment comes with unlimited coaching during business hours. They're just a phone call away.

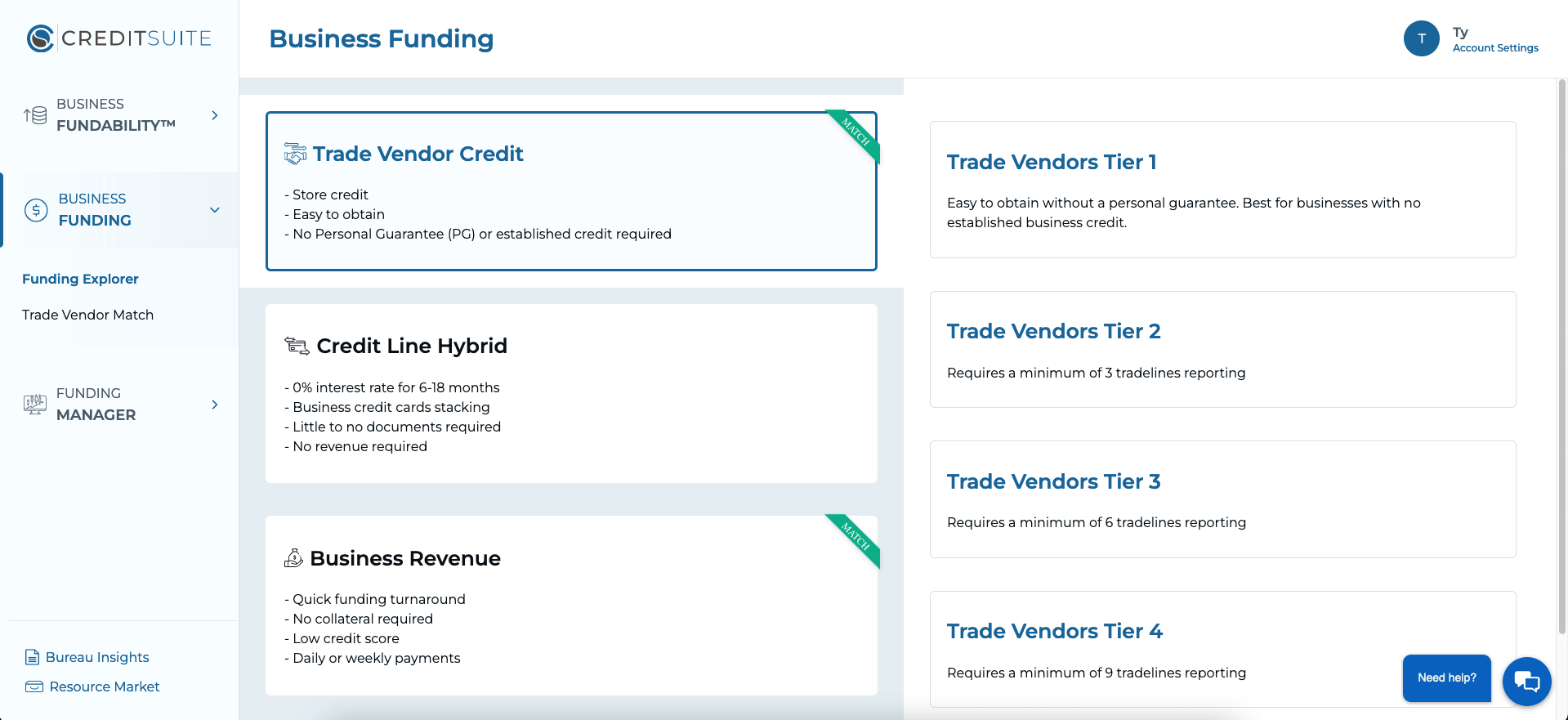

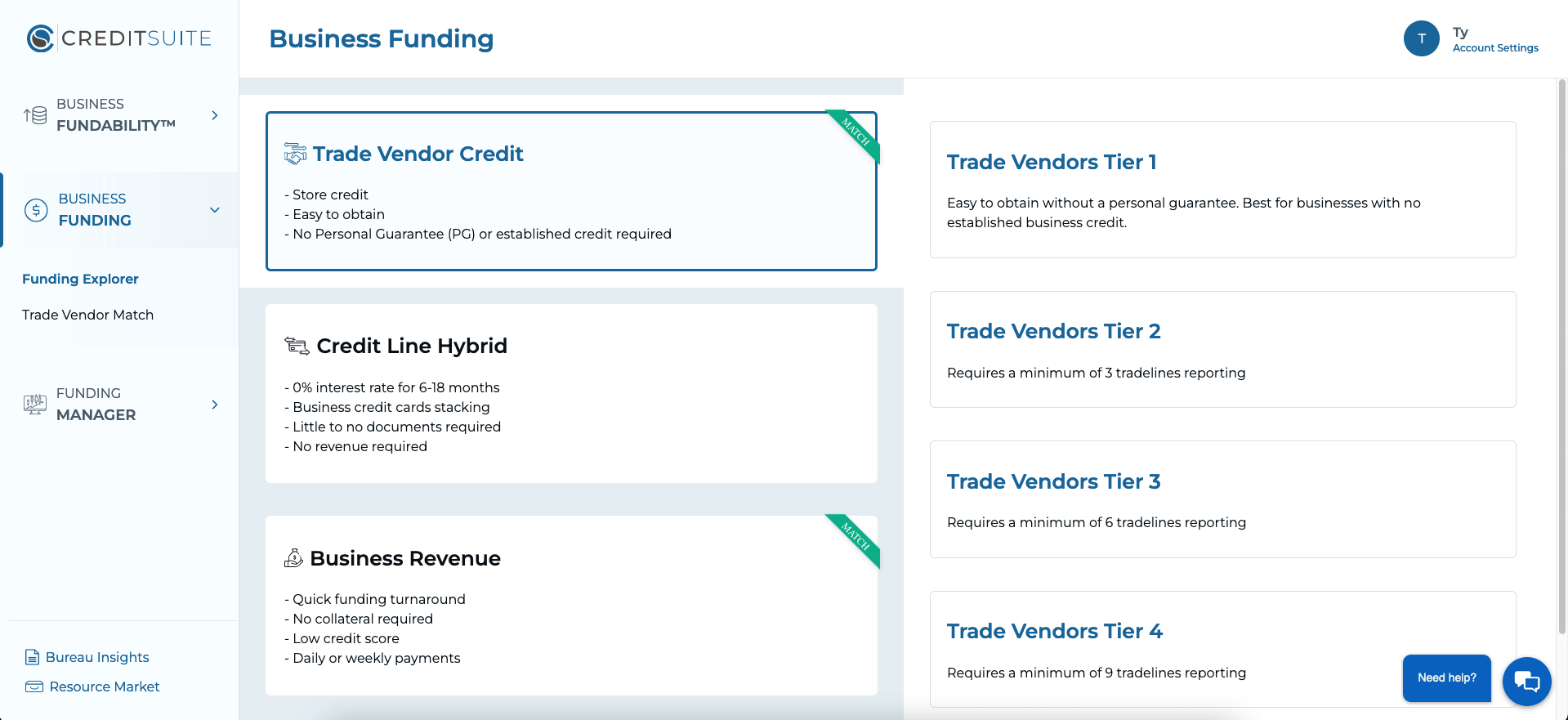

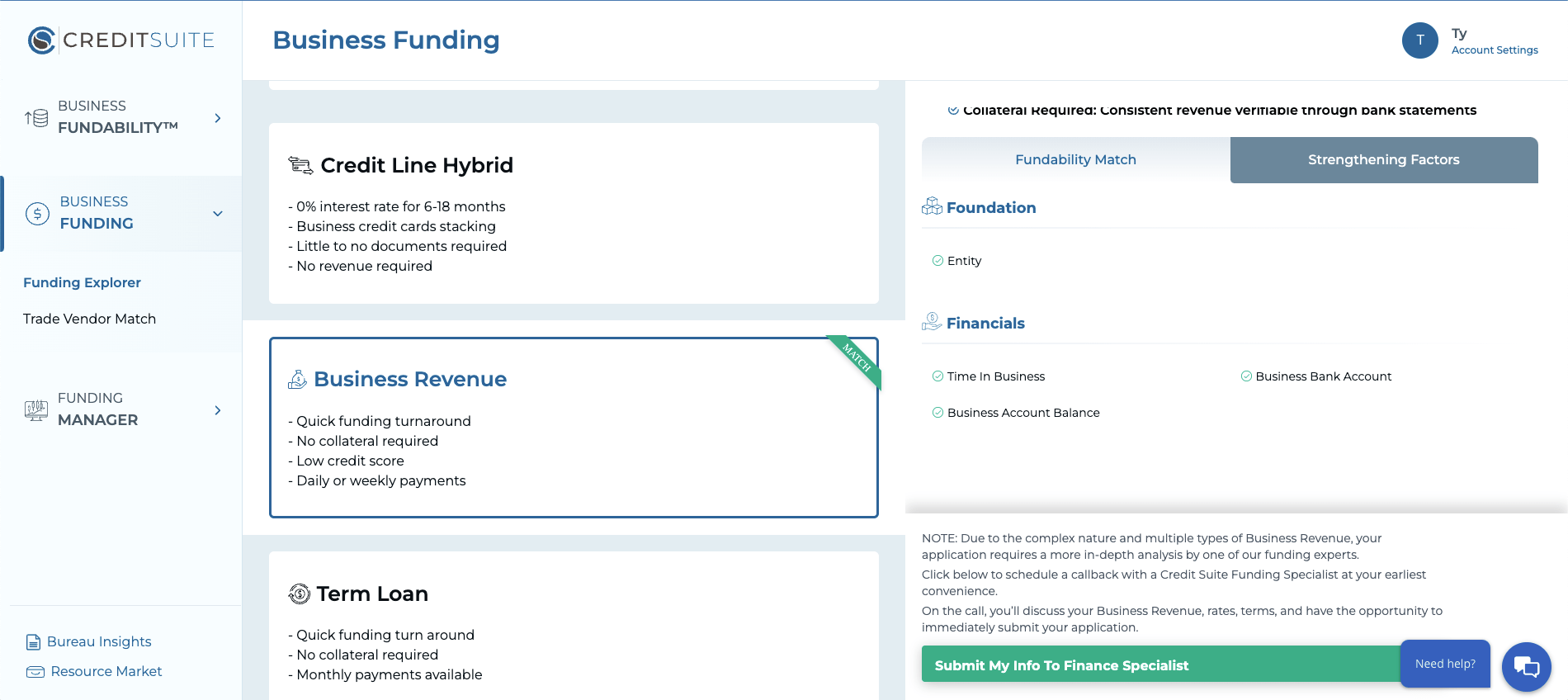

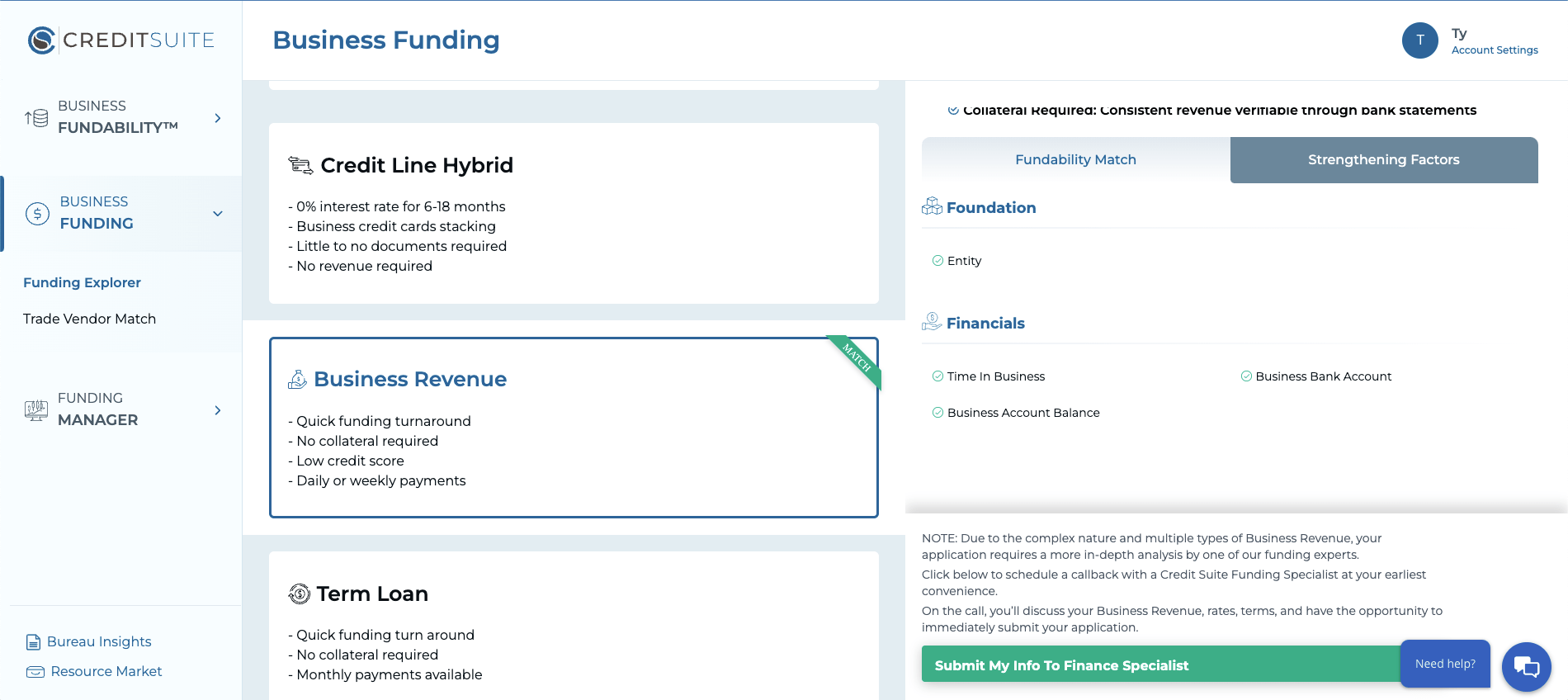

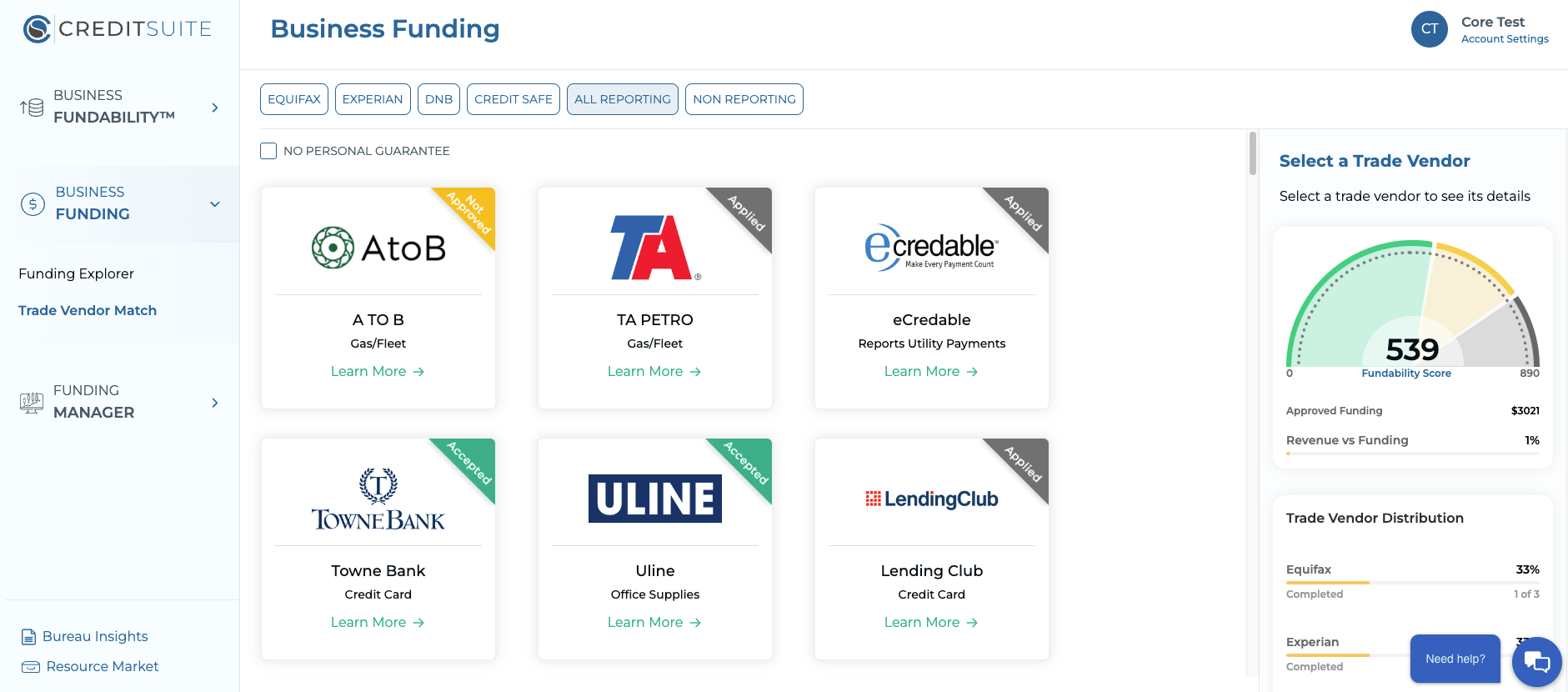

Our Funding Explorer contains one of the largest selections of business credit accounts and lending options available today. It also provides personalized recommendations for strengthening your Fundability and building your business credit step by step. Personalized recommendations help you to know which types of financing you currently match with now and what Fundability Factors you need to work on to qualify for more Fundability Matches™ with better terms, lower rates, and faster approval times.

Credit Line Hybrid/Business Credit Cards

Business Revenue Lending

Term Loans

Lines of Credit

Accounts Receivable Financing

Purchase Order Financing

Equipment Financing

Collateral Financing

Retirement Account Financing

Industry Specific Financing

Vehicle Financing

Securities

SBA Loans

Real Estate

Book of Business - Insurance Business

And More!

Starter Vender Credit

Store Credit

Service Credit

Retail Credit

Business Credit Cards - Mastercard/Visa

Fleet Credit

Company Vehicles

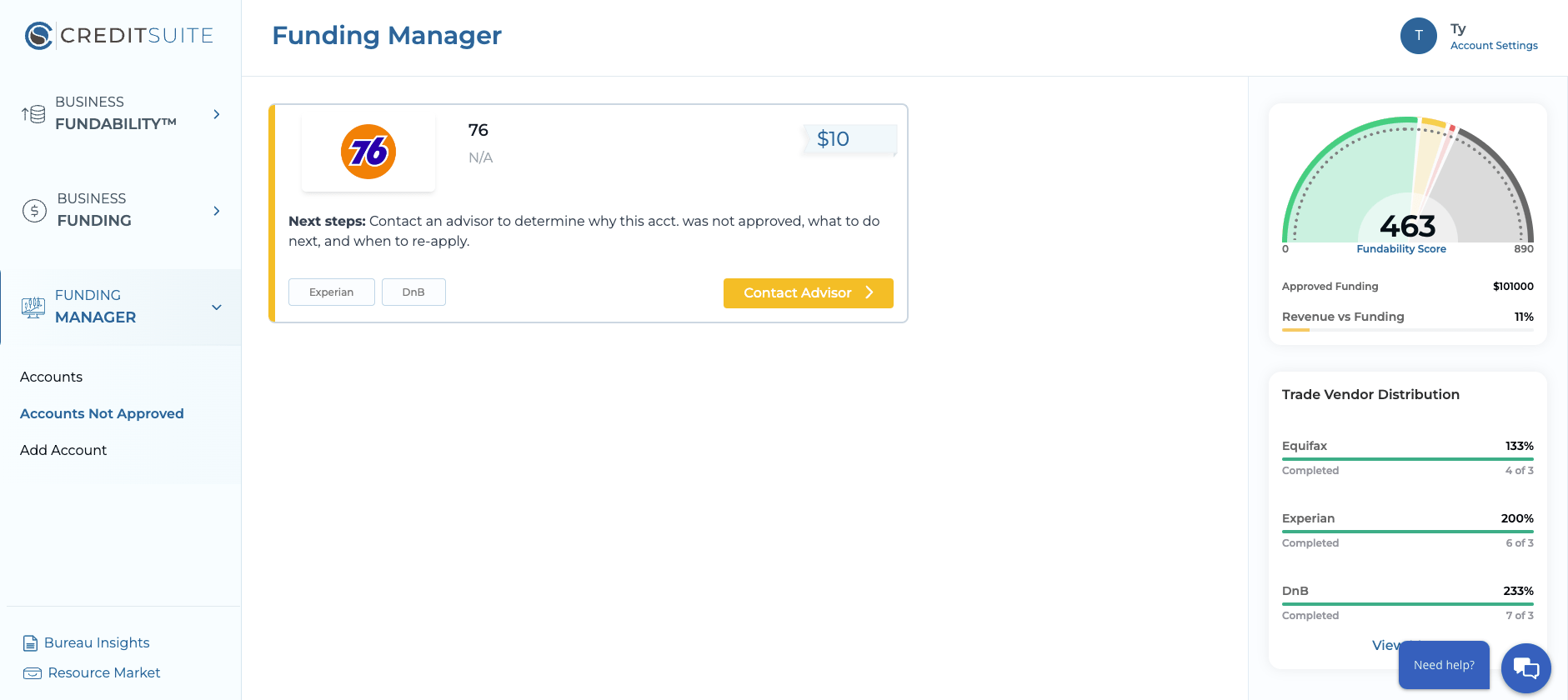

Easily determine the accounts you qualify for now with our Fundability Match™ accounts located in your Funding Explorer. As you build your credit and increase your Fundability, more and more funding opportunities will open up, giving you unprecedented access to high-limit revolving accounts. This feature expedites business credit building and eliminates the guesswork of what to apply for, while also increasing overall approvals.

Every vendor and revolving account listed in your Funding Explorer displays a complete set of details that make it easy to apply and get approved; including a description of the products and services each vendor sells, access to all account terms, the reporting agencies each account reports to, and a direct link to apply with or without a personal guarantee.

Our team works around the clock to vet thousands of creditors and lenders and keep their information up-to-date on a monthly basis, so you never have to question if a company still reports, if the underwriting criteria is no longer valid, if the rates and terms have changed, or what you need to do to get approved successfully.

The #1 frustration business owners have is that their accounts won’t report. We help business owners easily fix this by capturing all business information in the Business Info Aide, so that business owners can simply copy and paste their correct information into all applications. Getting this wrong adds MONTHS to the process. Getting this right dramatically speeds up your business credit building AND your ability to get approved for more money much faster.

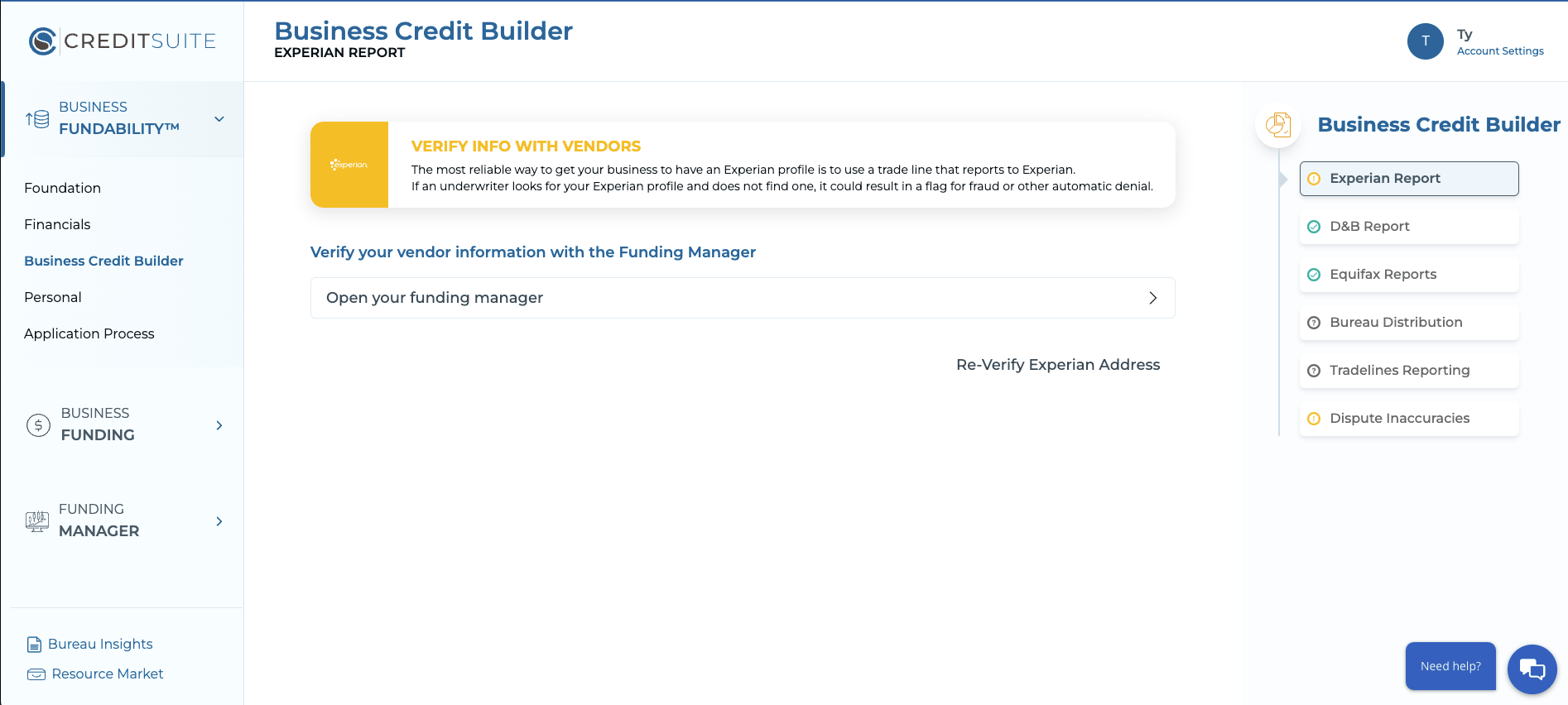

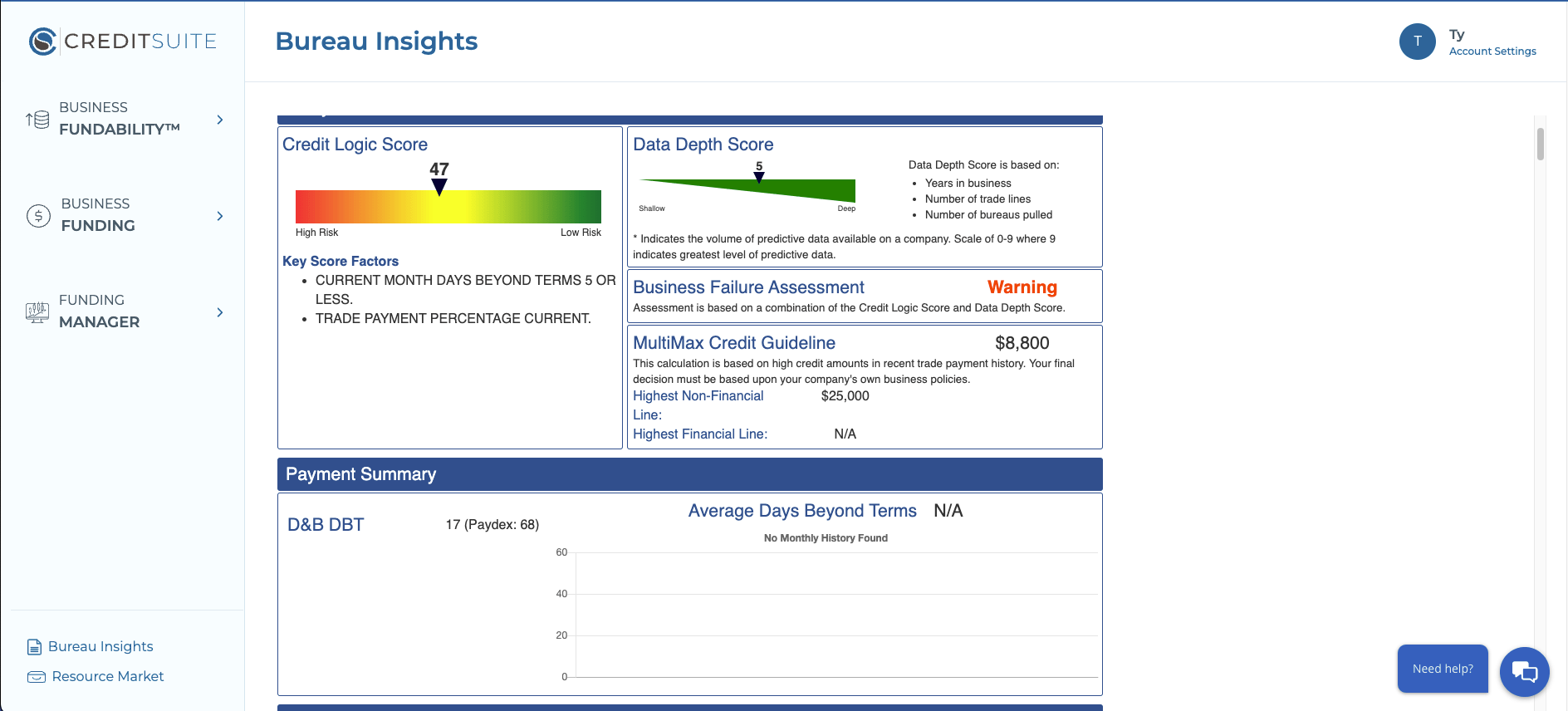

With our complete Bureau Integration, you get full access to the same Bureau Insights lenders and creditors use. PLUS … you can now instantly download your D&B, Experian, and Equifax reports and scores EVERY 30 DAYS to verify your accounts are accurately reporting and your business credit is booming … saving you time, money, and the added frustration of sitting on hold with countless customer service reps every time you have a question about your credit report.

Many types of financing are reviewed by the same underwriters, so if you've been denied for one account, you will likely be denied for others within the same network. If you have your heart set on a specific account, we’ll help you get it.

There’s so much information to track on business reports that the process can become very messy very quickly, causing business owners to lose sight of building business credit altogether. And with too many factors to track, it’s hard to know exactly what you should pay attention to MOST. We’ve identified critical key areas to track so you can zero-in-on what’s most important for building your business credit quickly.

Reporting vendors are absolutely crucial to building your business credit. Plus … these vendors are verified by our own team of advisors every 30 days to ensure they report to at least one of the main business bureaus, helping you to build a strong business credit profile and score with total confidence and less stress.

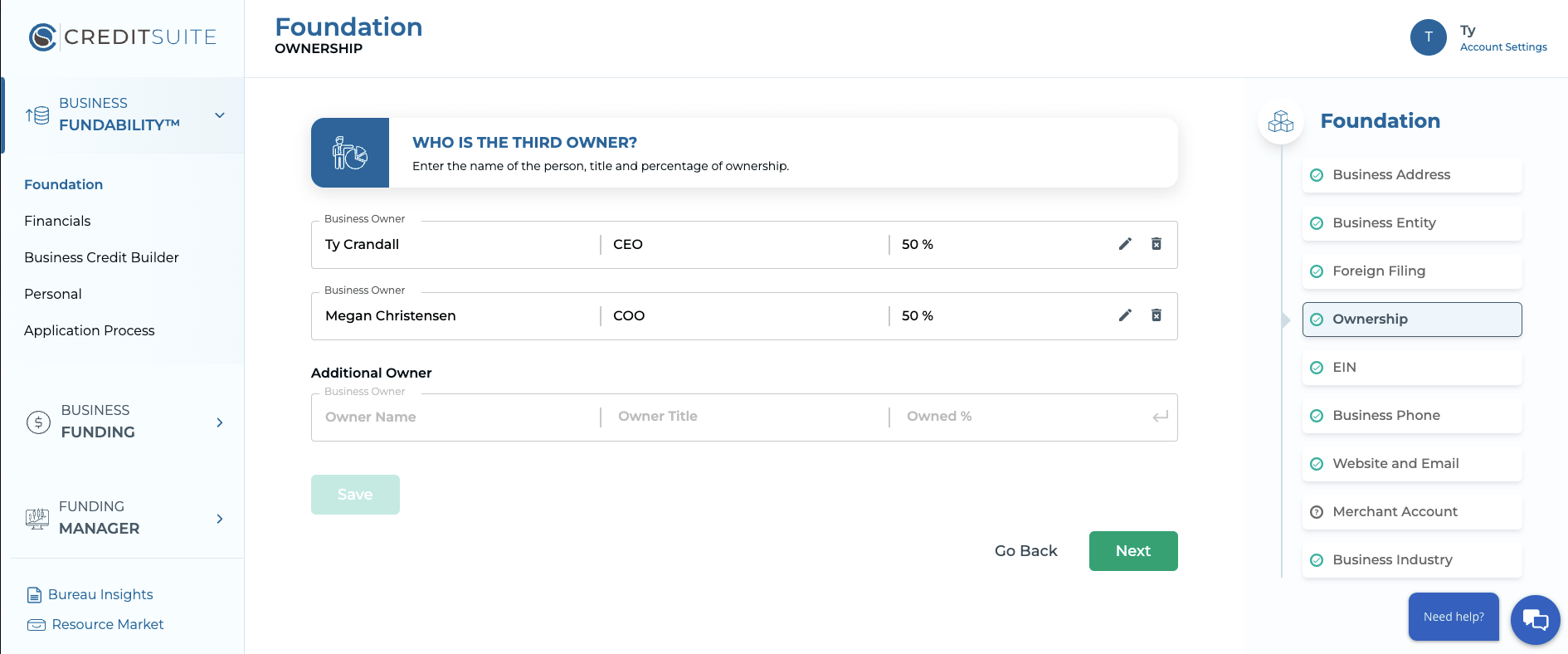

Adding even one business owner or additional credit partner into your FS can increase your funding opportunities and credit limits substantially, allowing you to prequalify for even more financing. Add a new business owner or credit partner at any time to unlock more funding options to move your business forward with solid confidence and greater peace of mind.

The Fundability Score is an indicator of where you are now, an expression of the overall health of your business’s Fundability, and it shows how likely it is that you’ll get funding with a lender or creditor today.

There’s so many different financing options and business credit building “gurus” out there … and nobody really knows what’s up to date, where the criteria is coming from, or even if the information is valid. One of the biggest benefits of our new Fundability System is that there’s no need to do endless Google searching – you can find what your business actually qualifies for, in addition to the most up-to-date business credit building requirements backed by current market research and nationally recognized business lending institutions that we partner with firsthand every day.

Our carefully selected business vendors help with every part of running and growing your business. In many instances, we've even secured some form of discount or bonus with these excellent companies … only for members of the CREDIT SUITE PRIME program.

Our Business Credit Advisors offer a complete concierge service—UNLIMITED access to one-on-one support—to help guide you through the Fundability process, bypass potential roadblocks, and expedite your business credit and loan approvals.

Choose your plan below to get started

Easy Monthly payments

$497/Month

$1,997/6-Months

SAVE 15%

with a two payments

SAVE MORE

$2,997/year

SAVE 30%

We’ve helped over 50,000 businesses get the credit and funding they need to start or grow a successful business!