What Banks Offer No Doc Business Loans?

Acquiring funds for your small business doesn’t have to be a tedious process. With a no-doc business loan, you can gain access to lines of credit, merchant cash advances, and other forms of funding without excessive documentation like a traditional loan.

What is a No-Doc Business Loan?

A no-doc business loan is a form of business financing that requires far less documentation than traditional business loans, including Small Business Administration (SBA) loans.

However, although the name implies that the business loan requires no documentation, most lenders still need some level of paperwork for no-doc business loans. Nevertheless, the requirements are much less tedious for this form of business funding than traditional loans.

There are four main types of no-doc business loans, namely a business line of credit, invoice factoring or financing, merchant cash advances, and short-term loans. We will go over these no doc business loan types in greater detail below.

Note: The information in this guide is for educational purposes only. It does not serve as financial advice. Before you apply for any of these alternative financing solutions, consult a financial professional. Terms and rates are always subject to change and business conditions; take care to verify current offers with lenders before applying.

Why No-Doc Business Loans? Why Apply for Alternative Lending Sources?

The SBA requires that you exhaust all other (reasonable) options to be eligible for its loans. Seeking out alternative lending is quite common.

According to the Federal Reserve, alternative funding from a finance company made up around 14% of the credit sources applied for in 2023. Meanwhile, around 23% of small businesses applied to online lenders.

What may be concerning is the amount of money small business owners pour into their businesses. According to the CFPB, securing funding can be difficult.

While the data they provide is older, an estimated 64.4% use personal and family savings to start their small business. With alternative lending, one can get started with less difficulty and without having to leverage their personal assets to begin their business journey.

No Doc Business Loans

| Business Loan | Amount | Notes |

| Credit Suite Credit Card Stacking | Up to $150,000 | 0% interest for 6 to 18 months. |

| Fundbox Working Capital Loans | Up to $250,000 | 4.66% for 12-week terms and 8.99% for 24-week terms. |

| Clarify Capital Equipment Financing | Up to 100% of the equipment value | APR as low as 6%. |

| Raistone Invoice Financing | $50,000 to $500 million | Fees based on invoices. |

| Greenbox Capital Merchant Cash Advance | Up to $500,000 | Factor rates between 1.1 and 1.5. |

| American Express Business Line of Credit | Up to $250,000 for select customers. Up to $150,000 otherwise. | Fees will vary. |

| OnDeck Business Term Loan | Up to $250,000 | APR varies. OnDeck states they can reach as high as 57.9% APR. |

| FundThrough Invoice Factoring | Unlimited funding for eligible invoices | 2.75% flat fee for one to 30 days, 3.75% for 31 to 45 days, 5.5% for 46 to 60 days, 8.25% for 61 days. |

| Bluevine Line of Credit for Small Businesses | Up to $250,000 | Rates as low as 7.8%. |

| TD Bank Business Solutions Credit Card | Credit limit will vary | 18.24%, 23.24%, or 28.24% APR. |

The Best No-Doc Business Loans (Including EIN-Only Options)

What banks offer no-doc business loans? What does your business need to qualify? We’ve compiled some of the top options for the savvy small business owner:

1. Credit Suite Credit Card Stacking Program

- Speed to Funding: Funding takes up to three weeks or less

- Minimum Credit Score Required: 680+ credit score with Experian, Equifax, and TransUnion

- Minimum Time in Business: N/A

- Documentation Required/Other Requirements: This is a true no-doc loan, but there are other requirements. These include:

- You need to have at least two open Credit Cards with two or more years of history and at least a $5,000+ limit. They must be a primary card.

- You can’t have had any late payments or charged-off accounts in the last two years.

- You currently need to have a credit utilization of under 40% for all revolving accounts.

- You can’t have more than three unsecured accounts open in the past 12 months.

- You can’t have more than four inquiries per bureau in the last 12 months. This doesn’t include secured inquiries such as those related to mortgages or auto loans.

- You can’t have any bankruptcies, liens, judgments, or unpaid collections.

- You must sign a personal guarantee or have a credit partner with at least 10% ownership sign one.

- Considerations Before Applying: Credit card stacking can become quite expensive if you let the 0% introductory period lapse. Make sure you’re ready to pay off your credit card balances before applying, as high rates can greatly affect your business after.

Credit Suite’s Credit Card Stacking Program offers flexible financing with no collateral and the least amount of documentation possible. This credit card stacking program functions like a line of credit, except the funds continuously revolve as long as the borrower repays the line monthly.

The Credit Suite Credit Card Stacking Program offers up to $150,000 per individual with 0% interest for 6 to 18 months. There are no income, assets, cash flow, or collateral requirements, making it a great alternative to a traditional loan or even an unsecured business line of credit for startup companies.

Aside from being a “no-doc business loan” as it can get and offering top-notch interest rates, the Credit Suite Credit Card Stacking Program takes three weeks or less to process, and you can get a pre-approval in 24 hours. These features make it easier for business owners to access business loan funds as quickly as possible, which can help pay for urgent business expenses or jump on sudden opportunities.

To qualify for this loan, you need a personal credit score of at least 680. Plus, you must not have any liens, judgments, bankruptcies, or late payments; have less than five inquiries per bureau in the last 12 months; and have under 40% utilization on all revolving accounts.

If you don’t meet these requirements for business lending, you can bring in a credit partner who does—perhaps a friend or business co-owner—to access their credit and provide a personal guarantee for the loan.

What will paying for this look like? Let’s say that you manage to secure $100,000 in funding.

You will need to pay a one-time fee of $9,900. APR will vary depending on which credit cards you’re approved for.

However, you’ll have an introductory period that will allow you to avoid interest entirely so long as you pay off the card before this period ends.

2. Fundbox Business Line of Credit

- Speed to Funding: Next business day (if approved)

- Minimum Credit Score Required: 600+ personal FICO score

- Minimum Time in Business: At least six months

- Documentation Required/Other Requirements: Fundbox requires no documentation. Applications can be done online in as little as three minutes. That being said, there are other requirements worth noting.

- You need to be a U.S.-based business.

- You need to generate at least $30,000 in annual revenue for this loan option.

- You need a business checking account that you can link to in order to proceed with funding. If you use Stripe, you can access Fundbox funding through your dashboard.

- Considerations Before Applying: Fundbox has shorter repayment periods than other loans, which are accompanied by fairly high interest rates. It is likely not to be a good fit if you’re experiencing cash flow issues and won’t be able to make the weekly payments.

Fundbox’s Business Line of Credit can get borrowers up to $250,000 to help pay for payroll, inventory, and other general business expenses. Repayment terms for this loan program are flexible, ranging from 12 to 24 weeks, and there’s no prepayment penalty.

A no-doc business line of credit is similar to a business credit card in the way it allows borrowers to pay for typical expenses without having to gather extensive documentation, as you would with a traditional business loan or secured loan. However, you would have to pay off the line to continue using it, just like a credit card.

A great thing about Fundbox’s Line of Credit is that you can apply entirely online. All you have to do is download their app, sign up for an account, and connect your financial software. If the lender approves your application, you can receive funding as quickly as the next business day.

Moreover, qualifications are less stringent than an SBA loan so that you don’t have to go through the stress of trying to meet SBA eligibility. To qualify for Fundbox’s Business Line of Credit, you need a 600+ personal FICO score when they conduct a credit check, $30,000 in annual revenue, and a business checking account. Applying with this lender is easy, and you can receive a decision in as little as three minutes.

Fundbox makes it easy to understand how much you can expect to pay with their pricing calculator. Say, for example, that you want a $20,000 loan. For 12-week terms at 4.66%, you’d be paying back the principal plus around $932. You can calculate how much you’ll owe and what weekly payments will look like on their website.

3. Clarify Capital Low-Doc Equipment Financing

- Speed to Funding: Get funding within one to two days

- Minimum Credit Score Required: 550+ credit score

- Minimum Time in Business: At least six months

- Documentation Required/Other Requirements: This is a low-doc business loan. You won’t do as much paperwork as you would with a traditional business loan. However, you’ll still need at least three to four months of recent financial statements. You’ll also need:

- At least $10,000 in average monthly revenue.

- Considerations Before Applying: Clarify Capital Equipment Financing offers quick, accessible funding, low APR, and desirable repayment terms that you want from this type of financing solution. Just make sure that you’re choosing repayment terms that work for you. If you select repayment terms that are too short, you could be making high monthly payments. If you choose repayment terms that are too long, you’re still paying even after the equipment is no longer being used.

For small business owners, new equipment tends to be the heaviest purchase, regardless of how long they’ve been operating. To help lighten this load for businesses, Clarify Capital offers a low-doc loan (minimal paperwork) for equipment acquisitions, including computers, heavy machinery, vehicles, and more.

With this type of low-doc business loan, you receive an amount depending on the price of the equipment you’re purchasing. Moreover, the length of the low doc loan will also rely on the expected life of the equipment, so it’s ideal to choose a repayment plan that matches how many years you expect to use the equipment.

The piece of equipment will serve as collateral for the low-doc loan. Once you pay off the low doc business loan amount, the lender transfers complete ownership to you.

Clarify Capital’s Equipment Financing lets small business owners borrow up to 100% of the equipment value with interest rates as low as 6%. The minimum personal credit requirement is 550, and the paperwork is minimal to ensure a smoother process.

Clarify Capital doesn’t state how long their term lengths are. This can make it difficult to calculate what you can expect to pay.

But let’s imagine that you manage to secure around $500,000 with 24-month loan terms and 6% APR. You’re going to be paying around $31,847.32 in interest, making your total $531,847.32.

New equipment often translates to business growth, but if you can’t afford to buy equipment with cash or apply for a loan from traditional banks, a low-doc equipment loan is a much more accessible alternative.

4. Raistone Invoice Financing

- Speed to Funding: Same day/next day

- Minimum Credit Score Required: N/A

- Minimum Time in Business: At least three years in business

- Documentation Required/Other Requirements: Documentation should be limited, as Raistone integrates with major invoicing and accounting systems to help you submit invoices seamlessly. Other requirements include:

- You generally need to generate at least $1 million in annual revenue.

- Your clients should use online invoice systems.

- You offer extended payment terms to your customers.

- Considerations Before Applying: Raistone offers flexible terms and fast funding. However, it’s not as available to small businesses as other financing options in this guide. While you may still be able to receive financing from them without meeting the average qualifications listed, you may have a harder time qualifying.

Invoice financing or factoring is a type of business financing that allows business owners to access funding quickly using outstanding invoices. With this kind of no-doc loan, businesses can use unpaid invoices as collateral or sell them to the lender directly.

This type of funding works best for businesses with a business-to-business (B2B) model and receivables. Usually, these companies sell goods or business services to large clients on credit.

The clients then receive invoices with the total balance and due date, meaning they don’t have to pay immediately after receiving the goods or services. For some, unpaid invoices can lead to cash flow issues.

Companies like Raistone offer invoice financing, which finances invoices to help businesses have liquidity sooner than having to wait for customers to pay their balances. The lender takes a percentage of the invoice as payment for the loan.

The qualifications for this type of loan vary. For instance, Raistone Capital borrowers qualify for an amount based on their revenue, their customers’ creditworthiness, and their payment terms. Moreover, this lender can integrate with customers’ invoicing platforms to help borrowers see what can be financed. However, these no-doc business loans can be structured in a way that the customers don’t know that their invoices have been financed.

Understanding what you might expect to pay isn’t clear with Raistone. Your costs will vary based on your invoices. Keep this in mind when you’re approaching them for funding.

5. Greenbox Capital Merchant Cash Advance

- Speed to Funding: As little as 24 hours

- Minimum Credit Score Required: A credit score of at least 550

- Minimum Time in Business: At least six months in business

- Documentation Required/Other Requirements: Greenbox Capital requires three months of bank statements and other financial records (not listed). Other requirements you will need to meet include:

- You have minimum monthly receipts of $7,500 or more.

- You accept credit and debit card payments.

- Considerations Before Applying: Merchant cash advances can help you get funding fast, and with factor rates rather than interest rates. The problem? Merchant cash advances demand daily or weekly repayments, which can impact cash flow. Should you run into a slow period, this could prove to be problematic.

Merchant cash advances (MCAs) provide a quick source of cash for businesses that need to increase working capital but have no collateral, making them some of the easiest no-collateral business startup loans.

Essentially, you are borrowing money against future debit or credit card sales. In return, the lender receives a percentage of your sales multiplied by a factor rate.

Most MCAs use factor rates instead of interest rates. Factor rates, which are usually between 1.1 and 1.5, are multiplied by the original loan amount. For example, a $50,000 loan with a factor rate of 1.1 will amount to $55,000.

Greenbox Capital offers a merchant cash advance to businesses averaging at least $7,500 in revenue per month for three months before application. Advances come to 70% to 120%, which can be anywhere from $3,000 to $500,000.

It’s a great option for establishments that need quick cash and process many card transactions, but have no collateral or have bad credit scores.

Another point of convenience for the Greenbox merchant cash advance is the minimal requirements, similar to other types of no-doc business loans. Generally, all you need are three months of bank statements and a handful of other financial documents. Credit approval can take as little as a few hours, and, if approved, Greenbox will deposit your funds within 24 hours.

6. American Express Business Line of Credit

- Speed to Funding: One to three business days

- Minimum Credit Score Required: A FICO score of at least 660

- Minimum Time in Business: At least one year

- Documentation Required/Other Requirements: American Express will ask you for your EIN, SSN, the industry your business is in, estimated annual gross revenue, and a linked bank account. Other qualification requirements include:

- You need to have an average monthly revenue of at least $3,000.

- Considerations Before Applying: There’s a lot to like about the Amex business line of credit. However, it’s worth noting that you’re more than likely to qualify for less than the maximum amount offered. More than that, their complex and non-transparent fee structure makes it hard to understand what to expect when applying.

American Express presents a flexible business financing solution to small business owners who need quick and easy access to funding. The Amex Business Line of Credit is available to borrowers with at least a 660 credit score, an average monthly revenue of at least $3,000, and 12 months of business operation. Amex Small Business Card Members may have pre-approval.

The lender will determine how much you can borrow based on your prior credit, repayment history, business bank accounts, and other information from your business and personal credit reports. Additionally, you can link your business bank account to your application to allow Amex to review your eligibility in real-time.

Essentially, you will have flexible access to the loan and can borrow as much as you need, when you need it. Each withdrawal is a separate loan with corresponding loan fees. You will then have to make monthly payments, and the line of credit may replenish based on an ongoing review of your financial profile.

You can apply for this line of credit through their online banking app and choose a 6, 12, 18, or 24-month loan term. Plus, you only have to pay fees for the amount you borrow, and there are no prepayment penalties if you decide to pay your balances on your no doc loans early.

There’s no telling exactly how much you can expect to pay with the Amex business line of credit. They don’t feature a fixed APR or fees. You’ll learn more about these terms during the application process.

7. OnDeck Term Loan

- Speed to Funding: As soon as same-day funding. Same-day funding and instant funding are subject to specific rules

- Minimum Credit Score Required: A FICO score of at least 625

- Minimum Time in Business: One year

- Documentation Required/Other Requirements: You will likely need to produce financial statements. Other eligibility requirements include:

- Having a business checking account.

- Generating at least $100,000 in annual revenue.

- Considerations Before Applying: The OnDeck business term loan isn’t a bad option, but there are some downsides worth noting. This includes potentially exorbitant interest rates, caveats for ideal terms like same-day funding, and the need for higher revenue. Keep this in mind before applying for an OnDeck business term loan.

OnDeck’s business term loan is similar to a traditional small business loan or personal loan, except the application process is faster and the required documents are fewer. This lender provides funding from $5,000 up to $250,000 with a flexible repayment term of up to 24 months. You can set daily or weekly payments and qualify for prepayment benefits if you wish to pay off the loan early and have the remaining interest waived.

In addition, OnDeck’s small business loan payments are fixed, meaning you’ll pay the same amount throughout the loan. This arrangement can help you manage your cash flow more efficiently and set up auto-debit on one of your business bank accounts with confidence.

Another benefit of OnDeck’s small business term loan is that the application won’t require a hard credit pull. You can complete your application quickly and, once approved, receive funding as soon as the same day. Plus, OnDeck reports to business credit bureaus, which will help you grow your business’s credit history and grow your business further.

What’s the difference between a term loan, like an unsecured small business loan, and a line of credit? With a term loan or unsecured business loan, you receive a lump sum rather than borrowing smaller increments with a credit line. This type of financing option is best for large expenses, such as buying new equipment, paying a deposit on a new property, and hiring additional employees.

That being said, OnDeck can be quite expensive.

Let’s say you get $200,000 in funding with 24-month payback terms at 31.34% APR with a 4% origination fee. You would need to pay $8,000 for the origination fee and approximately $71,703.50 in interest.

That’s a lot to pay back, and something to keep in mind if you might get saddled with much higher rates when using OnDeck.

8. FundThrough Invoice Factoring

- Speed to Funding: As soon as the next day

- Minimum Credit Score Required: N/A. However, having a score of around 600 to 700 is ideal

- Minimum Time in Business: N/A

- Documentation Required/Other Requirements: You will have to share the invoices you wish to get funding for. They offer integrations with major financial software that make this process simple. Other eligibility requirements include:

- While not defined as eligibility requirements, FundThrough typically works with businesses located in Canada or the U.S. that invoice large businesses (big box stores, major industry buyers, etc.) and are in industries like oil and gas, automotive, agriculture, and so on.

- You have an outstanding invoice of at least $100,000 in accounts receivable or invoices to one customer.

- You have B2B invoices or invoices with government agencies.

- Your invoices are for completed work and have an expected due date.

- Your business can’t be in construction or real estate.

- You can’t have any explicit liens on receivables that you aren’t willing to have removed.

- Considerations Before Applying: The most prominent concern with invoice factoring is that your customers may not like having to work with a third party to make payments. Aside from this, it’s important to note that rates will rise with repayment periods, which will cost you more over time.

FundThrough invoice financing aims to fill cash flow gaps resulting from unpaid invoices or slow-paying clients. With their invoice-funding platform, borrowers can receive funding for invoices in days rather than weeks or months, and all with an easy-to-use platform you can integrate with your QuickBooks or OpenInvoice account.

Aside from receiving payments early, another major benefit of using FundThrough is that the paperwork is minimal. With a free FundThrough account, you simply upload invoices or pull eligible ones from other accounting platforms, then choose an invoice to fund.

Once approved, FundThrough will deposit the loan amount into your account as soon as the next business day.

Their simple fee structure makes it easy to see how much working with them will cost. If you had $100,000 in invoices with net 30 terms, for example, you would pay a flat fee of 2.75%, which would cost you $2,750.

Aside from small businesses, FundThrough’s invoice financing has proven extremely beneficial for a lot of other industries, including but not limited to wholesale, engineering, information technology, automotive, agriculture, and trucking. Like other invoice financing companies, FundThrough works best for B2B businesses, but it can also be a viable option for business-to-consumer (B2C) businesses.

This type of flexible business loan can help your business grow faster by giving you the liquidity to invest in new equipment, hire more employees, purchase more inventory, or expand your building. But unlike a traditional business loan, you won’t have to shell out dozens of bank statements, credit histories, and other time-consuming requirements.

This makes it a desirable no doc loan to pursue when you need funding but don’t want to approach a traditional lender. It’s certainly a stated income business loan worth looking into.

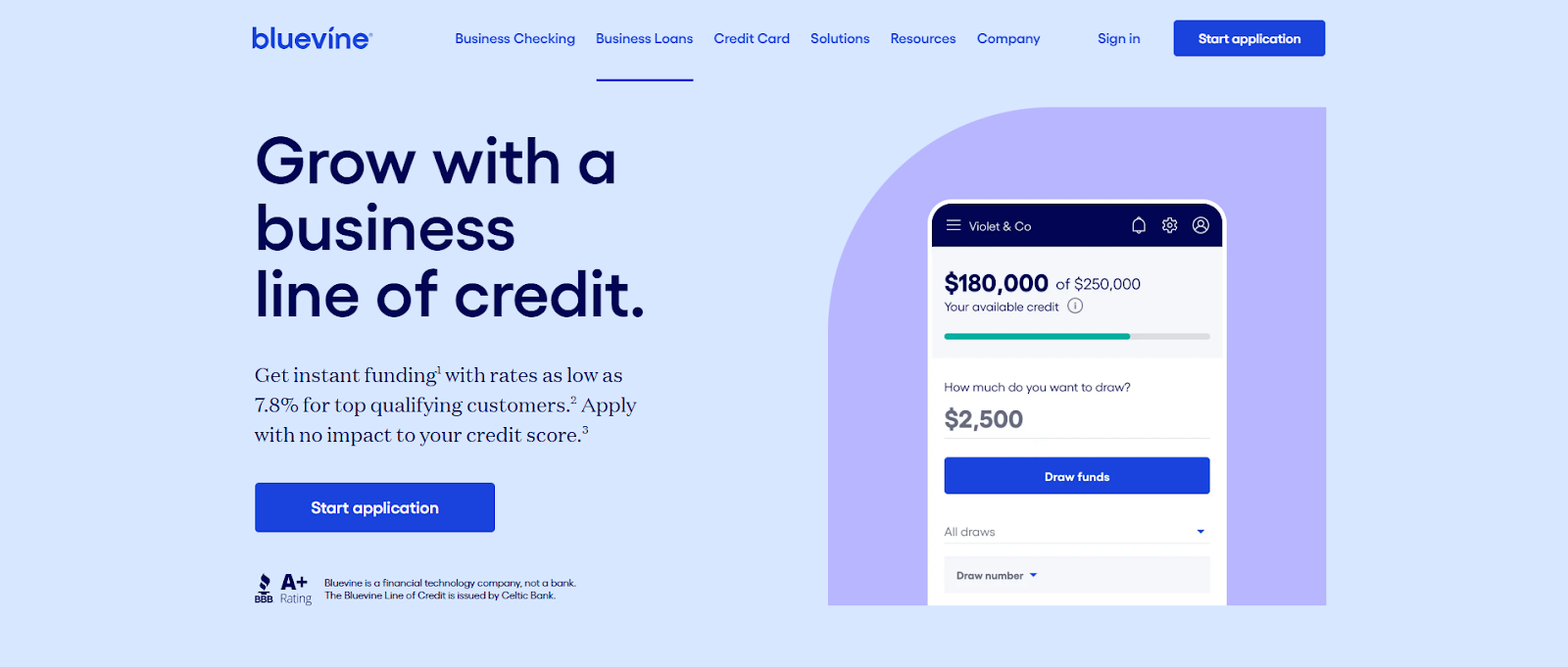

9. Bluevine Business Line of Credit

- Speed to Funding: As soon as 24 hours

- Minimum Credit Score Required: A FICO score of at least 625

- Minimum Time in Business: At least one year

- Documentation Required/Other Requirements: All you need to do to apply is provide your business info, connect your bank account, provide your personal details, and verify your information. Other eligibility requirements include:

- You must be a corporation or an LLC.

- You must have no bankruptcies on file.

- You must be in good standing with the Secretary of State.

- You must generate at least $10,000 in monthly revenue.

- You can’t be in any ineligible industries or states. For example, Bluevine doesn’t serve car dealerships, donation-based non-profits, or legal/illegal substances. It also doesn’t serve those in Nevada, North Dakota, and South Dakota.

- Considerations Before Applying: If you live in Nevada, North Dakota, or South Dakota, you’re prohibited from accessing this option. Rates can be rather high, and you may have to make weekly repayments. These potential drawbacks should be carefully noted before filling out an application.

Bluevine is another online lender that offers a line of credit up to $250,000. Like other no-doc business loans on this list, they allow borrowers to take only what they need and pay fees for only the amount they use. The line of credit is designed to help business owners access funds on demand and replenish their credit upon repayment.

However, your line of credit is not fixed. Bluevine continuously evaluates your financial profile and adjusts your limit, ensuring your business loan credit grows with your business.

To qualify for Bluevine’s business line of credit, you need at least 12 months of business operation, a 625+ credit score, and at least $10,000 in monthly revenue.

Moreover, you will need to present a bank statement. More specifically, you’ll need bank statements from the last three months, and your business must be in good standing with your Secretary of State. Note that businesses in Nevada, South Dakota, and North Dakota are not eligible.

With these requirements in mind, Bluevine’s no-doc business loans best fit medium to large businesses with a sizable, steady revenue, no bankruptcies in the past 12 months, and a good credit history.

Upon approval for these no doc loans, you can receive funding in as little as 24 hours. From there, you can repay each draw with fixed weekly or monthly payments over a 6- or 12-month period.

A Bluevine line of credit is easy to calculate to determine how much you’ll owe. If you get a $200,000 business line of credit with 12-month terms at 7.8%, for example, you would end up paying around $8,550.36 in interest.

10. TD Bank Business Solutions Credit Card

- Speed to Funding: You could be approved within minutes, but it may take longer. Additionally, you’ll have to wait for the physical card to arrive, which may take seven to 10 business days.

- Minimum Credit Score Required: TD Bank doesn’t list any requirements. However, the common consensus is around 670 or higher.

- Minimum Time in Business: N/A

- Documentation Required/Other Requirements: You’ll have to provide TD Bank with information like:

- Personal details and SSN.

- Annual income.

- Annual revenue.

- Basic business details.

- EIN.

- NAICS code.

- Years in business.

- Business legal structure.

- Considerations Before Applying: The TD Bank Business Solutions Credit Card is a credit card, which means that it comes with all the potential downsides of this financing solution. This includes high APR, credit limits that might not meet your expectations, and reporting to personal credit bureaus. If you do choose them, it will likely be their focus on acting as a rewards card for small to mid-sized businesses.

Business credit cards are a great option for borrowers who only need a small or moderate limit, smaller than a line of credit or other types of no-doc business loans. They are like startup business loans with no revenue requirements.

One such card is the TD Business Solutions Credit Card, which offers an unlimited 2% cashback on all eligible purchases, Visa benefits (e.g., cellphone insurance), contactless payments, and a $400 cashback (in statement credit) when you spend $3,000 within the first 90 days.

In addition, there are no rotating Spend Categories, caps, or limits, as long as your credit is in good standing, and no annual fee if you qualify. You can also add your credit cards to a TD digital wallet to streamline your online purchases and monitor your account more efficiently.

Most business credit cards offer smaller limits than business lines of credit and have higher interest rates. However, unlike a line of credit, a business credit card can come with rewards, including cashback and points, and may be accessible to those with bad credit.

How much your TD Bank credit card costs depends on various factors. This includes the APR terms associated with your card, how much of a balance you carry, and your repayment habits.

Selecting the Right Financing Solution for Your Small Business

This guide presents numerous options for alternative financing. But while they’re all a good choice if you want no-doc business loans, they may not be appropriate for your business specifically.

How can you make sure you’re choosing the right product?

Here’s a brief breakdown of each of these alternative financing sources and who they’re best suited for.

- Credit Card Stacking: If you have good personal credit, have just started your business, and plan to repay your loans quickly, credit card stacking is a solid financing option.

- Business Line of Credit: A business line of credit is a good option for startups and small businesses with challenges accessing traditional loans. You can often secure a business line of credit with poor credit and low annual revenue. It helps you boost your cash flow and presents fewer application challenges.

- Invoice Financing: Invoice financing is designed for businesses facing cash flow challenges due to slow payments. If you’re confident in your customers’ ability to pay and need cash now, invoice financing is a useful financing solution.

- Equipment Financing: Does your small business need equipment? Are you unable to make a sizable upfront investment to acquire it? If so, equipment financing provides you with the funds and the manageable payment plan you need to purchase equipment.

- Merchant Cash Advance: If you have strong sales but struggle to secure funding, a merchant cash advance can help. MCAs are easy to qualify for, offer fast funding that is based on your sales, and don’t require collateral.

- Invoice Factoring: Invoice factoring is similar to invoice financing, with the exception that, in invoice factoring, you sell your invoices rather than treating them as collateral. The company you sell them to becomes responsible for collections. They’re also beneficial when you need to boost cash flow and need easy funding fast.

- Business Term Loan: Business term loans are great when you need a lump sum of cash with long-term payback periods. Some business term loans are difficult to qualify for, but there are always exceptions to the rule. Bluevine is an excellent example.

Conclusion

A no-doc business loan can be an excellent alternative to traditional small business loans from a bank or credit union, especially if you need a sizable amount of funds quickly. No-doc business loans can also be a viable option for business owners with bad credit, low revenue, or a limited business history. Whatever the case may be, the most important takeaway is to choose a business loan that will work best for you, no doc loans or otherwise.