This blog may contain affiliate links that might result in Credit Suite receiving a commission if you use them. This has no impact on the price you are charged for the product or service.

Getting a DUNS Number

If you have ever heard of business credit (and building business credit), then you have most likely heard of the Dun & Bradstreet DUNS number. But do you know how to get a DUNS number?

Follow along with our easy guide to getting this vital identification number for your small business.

Step 1 – Register on the Dun and Bradstreet Website

Firstly, Dun and Bradstreet requires that you register your United States company on their site before sending a DUNS number. Registration is free.

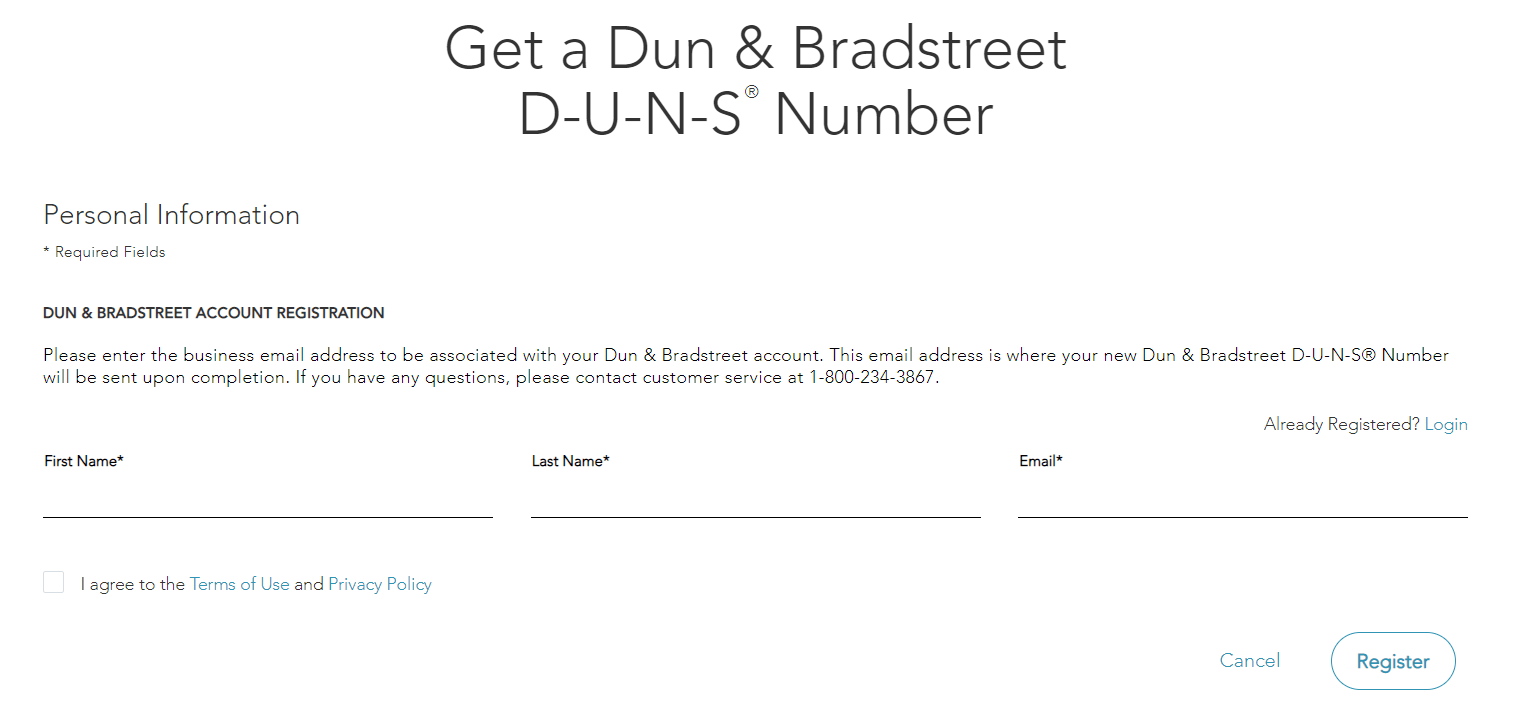

Input your full name, an email address, a password, and then confirm that password. Since that is all they want from you, you can get a registered Dun and Bradstreet account on the DB website even before you even create your small business! You may as well do this early.

When you register to get a DUNS number free online, Dun and Bradstreet sends a confirmation email. This also gets you on the Dun and Bradstreet mailing list.

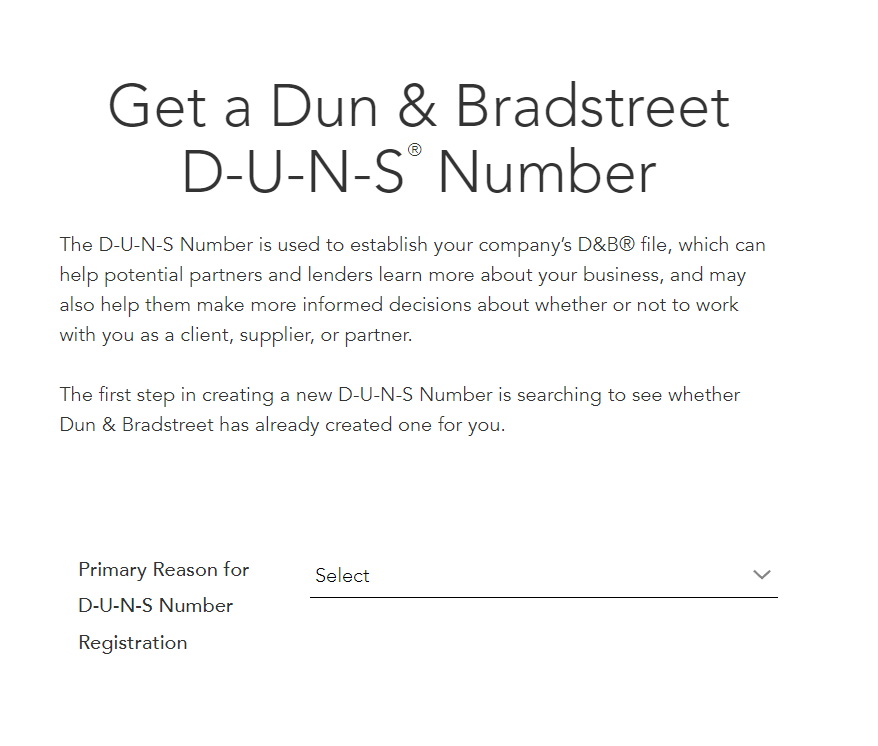

Step 2 – Look Up Your DUNS; If You Have no DUNS Number, Click on Get a New D-U-N-S Number

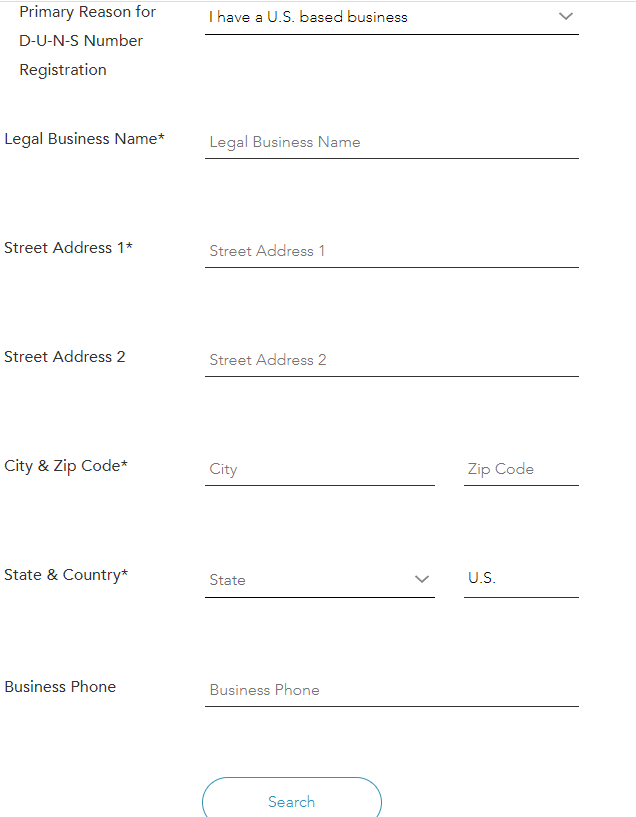

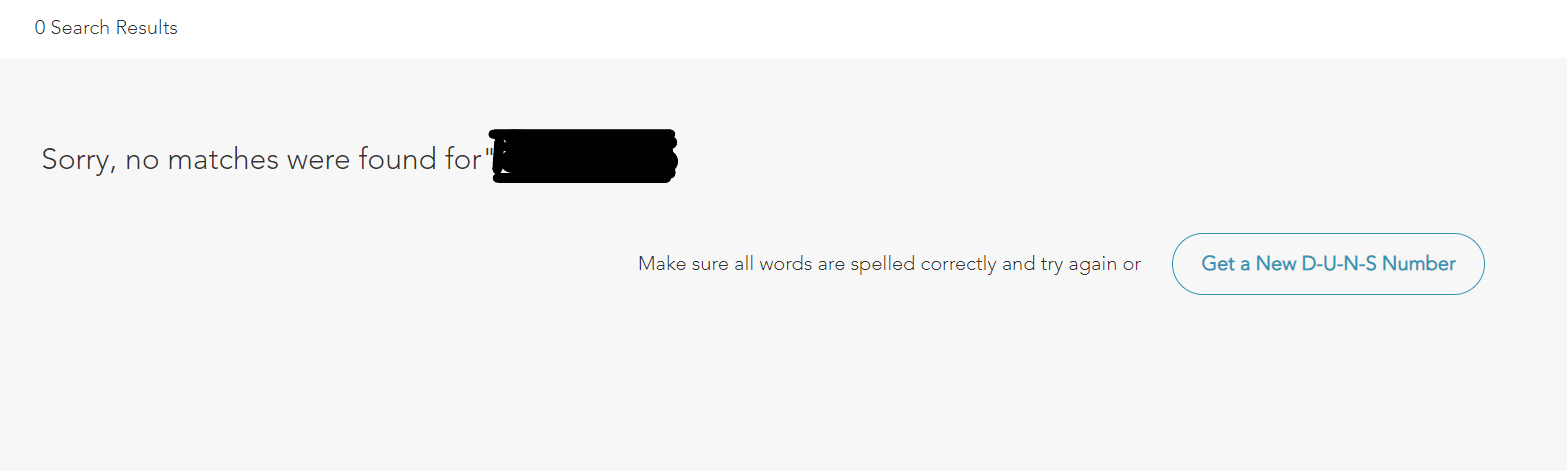

Secondly, on the D&B DUNS lookup page, enter your business name and, at the very least, the state the business is in. If you cannot find your business, click on Get a New D-U-N-S Number.

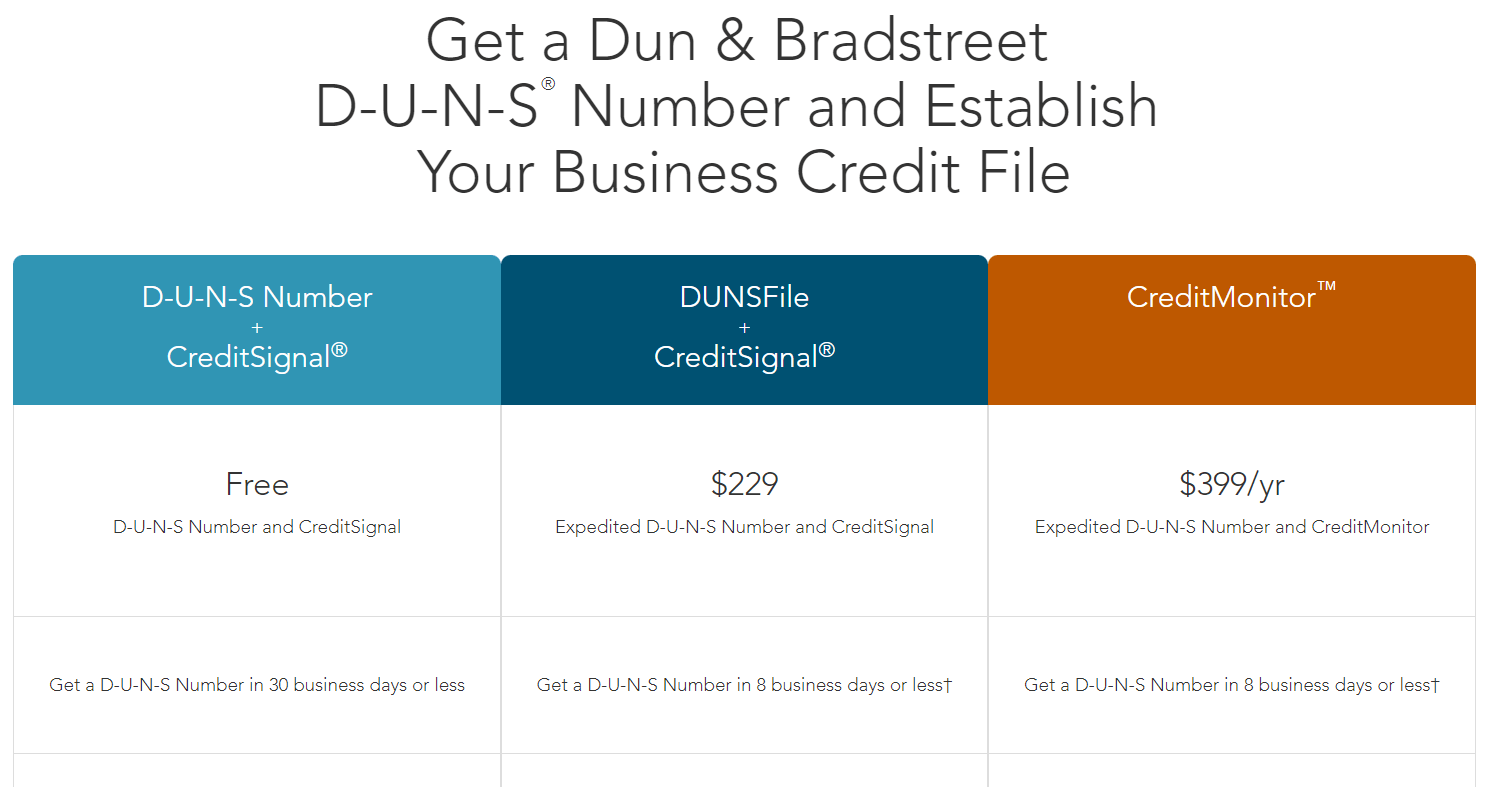

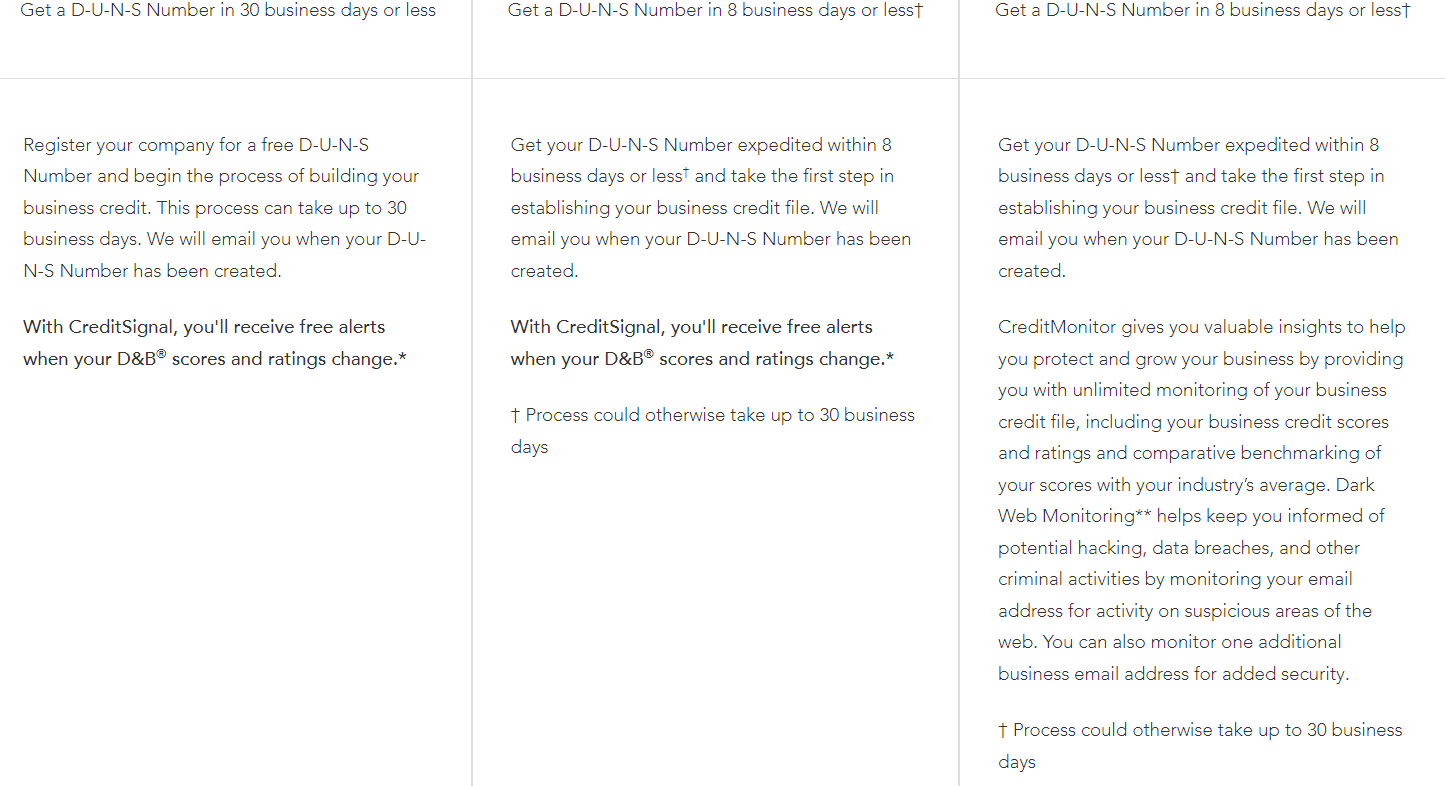

Choose the option you prefer (free, etc.) and click Get Started.

Personal Identification Information

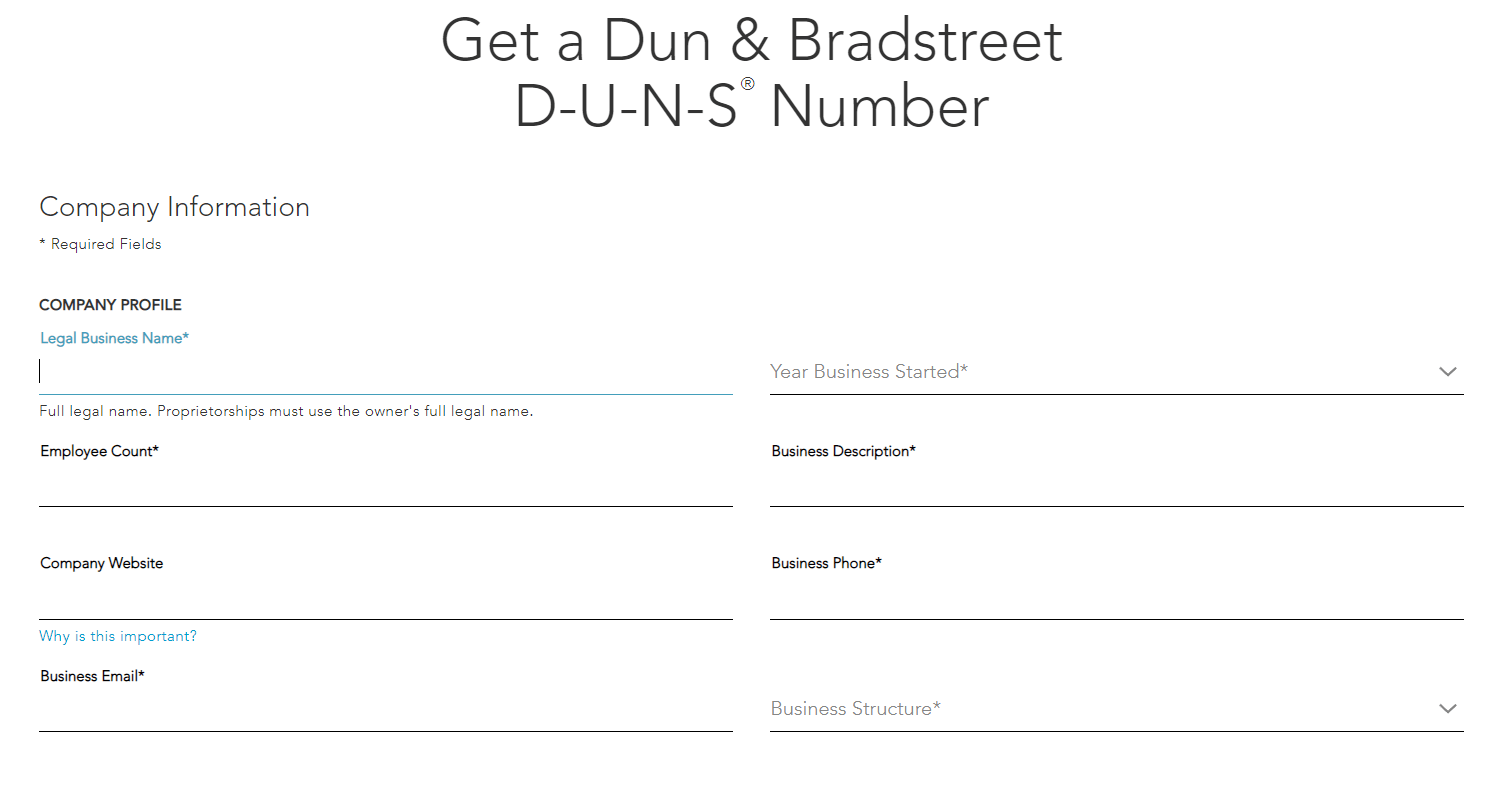

If you have not yet registered, you must fill out a section with personal information like full name and mailing address. Once registered, you must fill out a business information section which includes your business email and physical address.

Once you have filled these two sections out, go to Step 3.

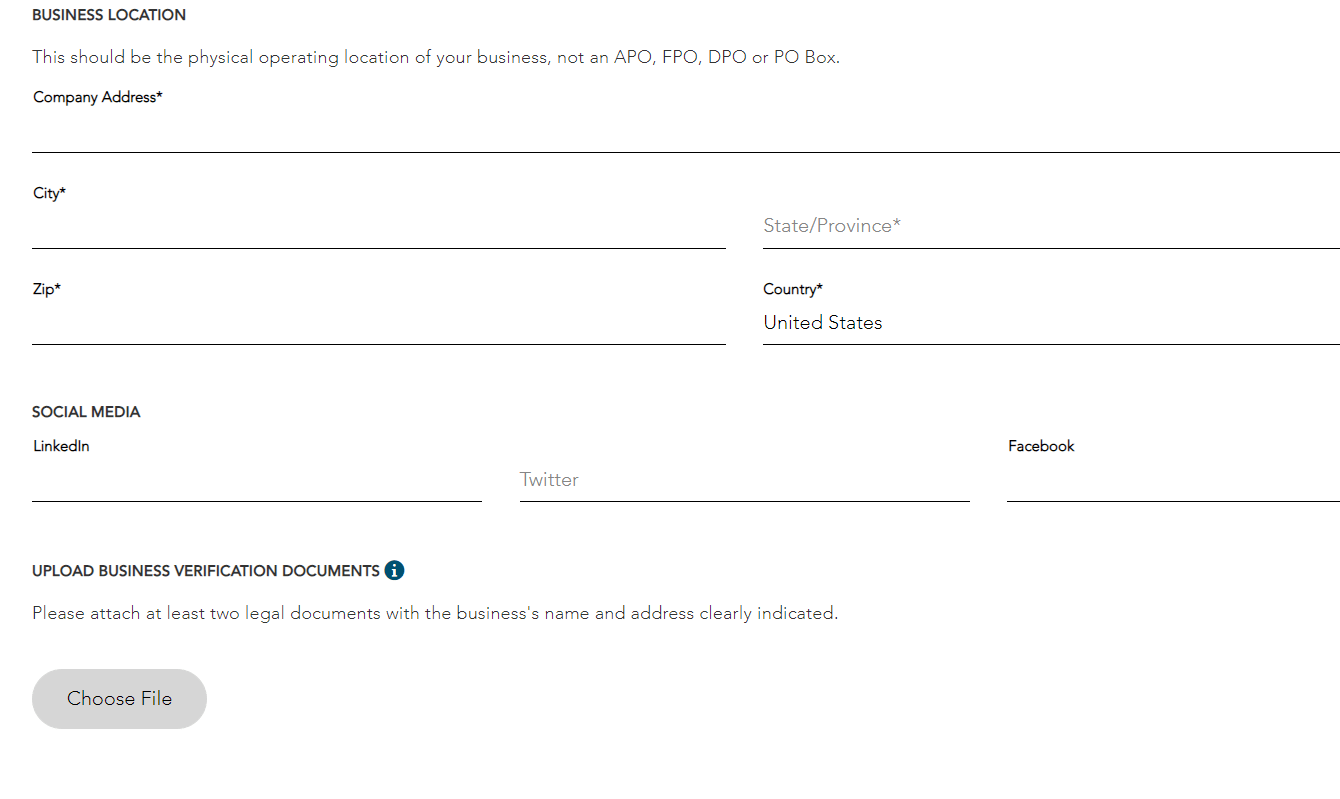

Step 3 – Upload Your Business Verification Documents

Thirdly, you need to upload business verification documents.

D&B accepts any of these document types. They recommend uploading two documents from the list:

- Articles of Incorporation/Certificate of Amendment of Articles of Incorporation/Secretary of State Approved Business Registration/Secretary of State Certificate of Filing

- Proof of business phone service

- Proof of a utility bill in your company’s name

- EIN/TIN Confirmation Letter

- Proof of business insurance like a workers-compensation policy or casualty insurance

- Proof of a business lease (i.e., building, vehicles, equipment)

That’s it! You’ve successfully requested a free DUNS Number and will get it within 30 days.

Step 4 – Get Your Free DUNS Number Via Credit Suite Using Our Business Finance Suite (an Alternative)

Finally, as an alternative, you can get your free DUNS number from Dun & Bradstreet through Credit Suite by using our Business Finance Suite. This is through our Step 2.

It is very important to make sure that the address, business name, phone number, and other identifying information you provide to Dun & Bradstreet perfectly matches your company information in other places, such as the Internal Revenue Service website and your applicable Secretary of State’s office.

Your creditors will check the business information on your Dun and Bradstreet business credit report against public records. If there are any variances, it can potentially lead to a decline.

How a DUNS Number Can Help You

There are many uses for a DUNS number.

1. System Identification

In D&B’s system, the DUNS is a unique identifier for working with data.

2. Possible Future Business Partners

Potential partners, investors, and customers use a DUNS Number to determine a company’s viability.

3. Federal Grants: the Government Grant Application

Local and state governments and agencies like NASA Nspire require federal grant applicants to have a DUNS to receive grant funding.

4. Build a Business’s Credit Identity

With a DUNS, a small business can establish a credit file and business credit score with payment experiences reporting from vendors. Other businesses and vendors can assess creditworthiness and financial stability.

5. Supplier Registration

A DUNS is mandatory for supplier registration with Bank of America, PNC, and Wal-Mart.

6. Business Customer and Vendor’s Business Credit Reports

Customers, vendors, and suppliers use DUNS numbers to check financial stability, determine if a federal government contractor can fulfill a government contract, or decide how much credit to extend to businesses.

7. Bank and SBA Loans

A DUNS Number is required on business loan applications, so lenders can get a copy of a company’s credit file. The SBA uses a DUNS to report loans to business CRAs.

Requirements for a DUNS number

Unlike with personal credit and your Social Security number, a DUNS is not automatic. Rather, a business will have to proactively seek out and get a DUNS number.

To get a DUNS number, you will need to register on the Dun & Bradstreet website. You must provide the following information:

- Legal name of business entity

- Address

- Telephone number

- Name of the CEO or business owner

- Legal entity status (corporation, partnership, sole proprietorship, etc.)

- Year the entity was created

- Primary line of business

- Total number of employees (full- and part-time)

You also need to provide certain documents. Dun & Bradstreet recommends two or more of the following:

- Articles of Incorporation/Certificate of Amendment of Articles of Incorporation/Secretary of State Approved Business Registration/Secretary of State Certificate of Filing

- Proof of your business phone service

- Proof of a utility bill in your company’s name

- Employer Identification Number/TIN Confirmation Letter

- Proof of business insurance like a workers-compensation policy or casualty insurance

- Proof of a business lease (i.e., building, vehicles, equipment)

Since most businesses should already have at least two of these documents, particularly when they have built a Fundability Foundation™, these requirements should not be burdensome. Even a home based business can likely fulfill all of these requirements.

What is the difference between SAM and DUNS numbers?

So, SAM, the US government’s System for Awards Management, recently unveiled the Unique Entity Identifier. The federal government used to use the D U N S number to identify entities in their system.

The government has stopped using DUNS numbers on government official websites and for SAM registration. But instead of making D&B a partner, the government created a unique ID.

Now, they streamline entity identification and validation. If an entity does not already have a DUNS number, they won’t need one to register on the SAM website, making it easier and less burdensome to do business with the federal government.

Takeaways

DUNS numbers are well-known business identifiers. They open doors to several types of funding, and can even help you choose a business partner. Not having a DUNS number can mean shutting your business out of lucrative opportunities.

Contact us today for more information on DUNS numbers, business credit, and financing.