Some fundability elements are impossible to control. For example, time in business. You can only change that by staying in business. However, others can be controlled by you as the owner. One of the things you can control is how you set up your business office.

Factors Affecting Fundability

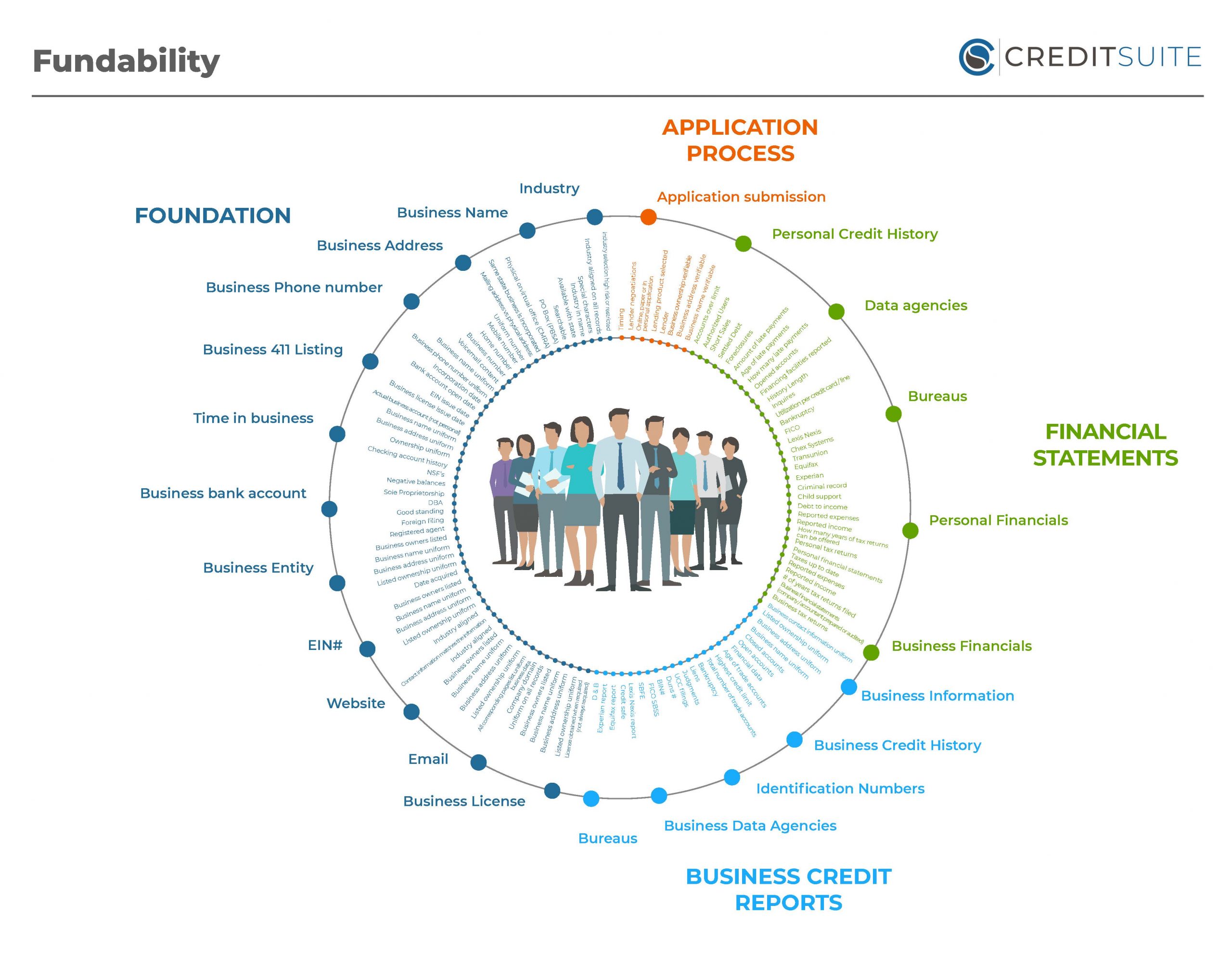

Truly, it can be overwhelming when you start to realize just how much affects the fundability of your business. In fact, there are 125 factors that affect fundability. They can be broken down into 4 main principles.

- Foundation

- Business Credit Reports

- Financial Statements

- Application Process

Still, most business owners realize that their business credit reports and financing statements affect their ability to get funding. Yet, few realize the actual process of applying for funding can make a difference. While many may realize that some parts of the way their business is set up can affect fundability, most business owners do not realize the depth of detail involved.

Foundation of Fundability

Your business has to be set up in a very specific way to build fundability. Each step is vital, and if you miss one, it could do more harm than you may think. For example, you need an EIN and you need to incorporate. This may or may not surprise you, but it probably makes sense.

Your business has to be set up in a very specific way to build fundability. Each step is vital, and if you miss one, it could do more harm than you may think. For example, you need an EIN and you need to incorporate. This may or may not surprise you, but it probably makes sense.

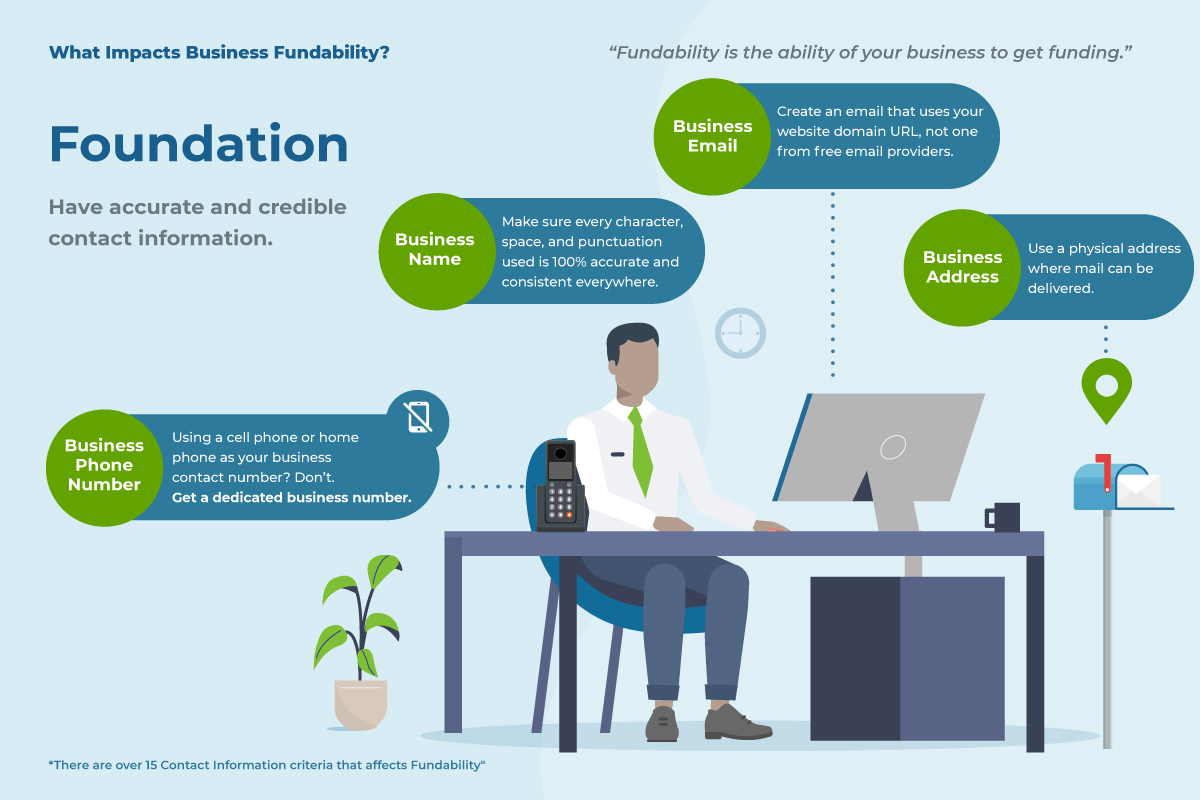

What does not make sense to a lot of business owners, is the idea that much of what has to do with their actual business office can affect fundability. Details such as business name, business address, phone number, even website and email address can make or break your ability to get funding for your business.

Your Business Office and Fundability

When it comes to your business office and fundability, here’s what you need to consider.

- The name of your business and whether it is consistent everywhere it is used

- Your business address

- Your business phone number

- Business website and email address

Business Name: Risk

Yes, the name of your business affects your ability to get funding. First, it should not indicate that your business is one that is risky. If you are opening a business that is considered to be high risk by the lender, for example a travel agency, do not name it “Carla’s Travel Agency.” You can name it Carla’s, or anything else that does not make it obvious that this is a high risk business.

Honestly, it’s just a way to ensure that you make it as far into the process as possible without being denied for funding. Depending on the lender, they could deny immediately if they can see at a glance that the business is in a high-risk industry.

Business Name-Consistency

Your business name has to be consistent. If you list it one way on your application and it is different anywhere else, whether on your business card, your phone listing, your website, or the Secretary of State’s office, enders will likely deny.

In fact, even seemingly small details like using an ampersand in one place and the word “and” in another can cause denial. Inconsistency throws up a red flag for fraud. Unfortunately, a lot of lenders will not investigate. Instead, they will just deny.

Business Address

The actual physical location of your office doesn’t matter as much as the address. Lenders want to see a physical address where you can receive mail. That means no P.O. Box or UPS Box. If you are homebased and do not want to use your home address, a virtual office can work.

Here are three virtual office providers we love:

If you go this route, keep in mind some lenders and credit providers will not accept virtual offices.

What if Your Area Doesn’t Have Virtual Office Providers?

Get creative! Consider talking with local business owners to find out what they do. There may be options for shared spaces. It might help to talk to local computer user groups too, or consider going out of state if you are close to the border. They may open more options, but pay attention to tax laws.

For example, neither Tennessee or Texas have state income taxes, but Arkansas does. Some border cities in Arkansas have exemptions, but others do not.

Not wanting to use your home address is understandable. Still, realize your address isn’t hard for anyone to get regardless. As a result, a virtual address isn’t a lot of protection. They can be a good option, but using one could limit your funding options somewhat.

Business Phone Number

You need a dedicated, separate number for the business only. It should be toll-free. Voice Over Internet Protocol (VoIP) is fine, and you can forward your business number to your personal phone if you want.

Business Website and Email Address

Stay away from free web hosting and email services. Your business website is your first impression on many, including lenders. As such, it should look good and work well. Of course, It should be user friendly also. It’s wise to hire a professional web designer.

Your business email address should have the same URL as your website. Often, email can be included in your hosting package. Do not use an account from Gmail, Yahoo, or any other free email service.

How Your Business Office is Set Up Impacts Fundability

How you set up your business office affects fundability. The good news is, this is a factor you can control. If you are already up and running, make any needed changes now. The sooner the better when it comes to building fundability.