What is an EIN? EIN stands for Employer Identification Number. As a result, referring to it as an EIN number isn’t exactly correct. Despite the redundancy however, the terms EIN and EIN number are used interchangeably by the general public. The important thing is, having one for your business is vital to building a Fundable™ Foundation. It’s like a Social Security Number for your business. You can get one for free from the IRS. But, what exactly does this entail? Here is how to get an EIN, step-by-step.

How to Get an EIN Number Step-by-Step

Here’s a quick and dirty rundown.

- Go to IRS.gov.

- Fill out the online application.

- Submit

- Get your number.

Sounds easy enough, right? Still, sometimes walking through the process and actually seeing it is a little easier.

How to Get an EIN Number: IRS.Gov

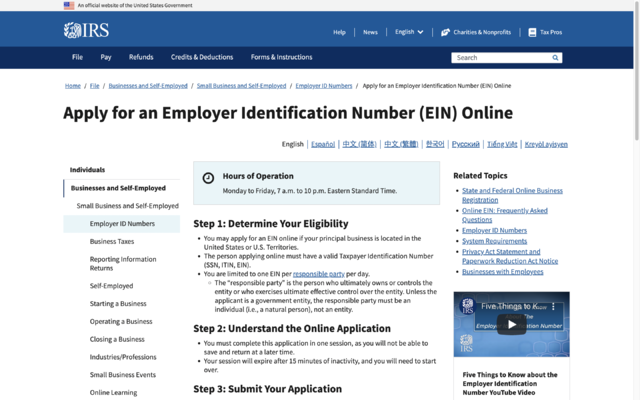

It’s easy to say “go to the IRS website.” However, it is a big site with links to what seems like an endless number of topics. So, specifically the first step to getting an EIN is to go here. You’ll see this:

Read this page closely. Make sure you are eligible. If you are, you can continue to the online application by clicking the “Apply Online” button.

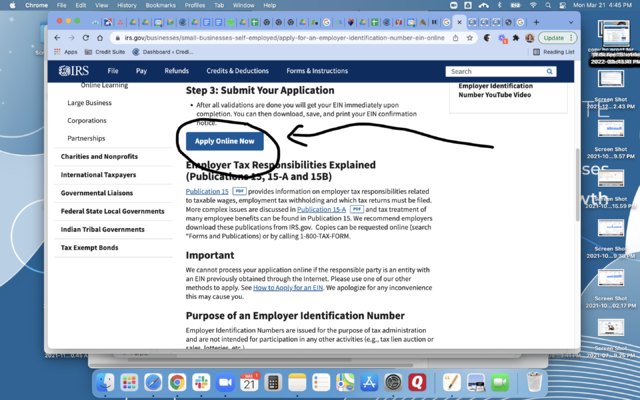

How to Get an EIN Number: Apply Online

After you click the button you’ll go to the application. It starts like this.

Read it, and if you are continuing, click “Begin Application.”

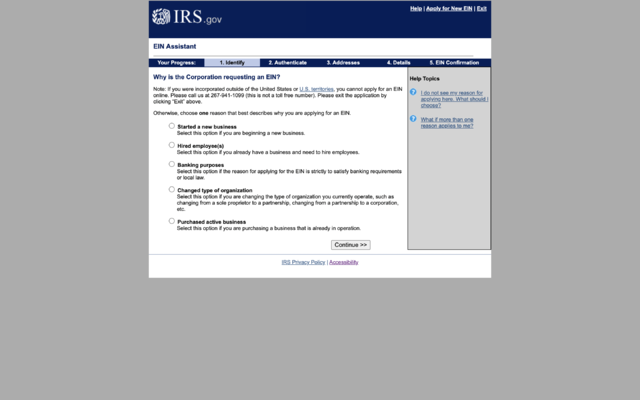

Next, you’ll see a screen asking you to choose your legal structure.

Choose Your Legal Structure

For Fundability purposes, you’ll want to incorporate. Hopefully, by this point you have already done so and you’ll choose “corporation.”

Then, you’ll be asked which type of corporation your business is.

Choose Your Business’s Corporation Type

Before you apply for an EIN, discuss with your attorney or tax professional which type of corporation is best for the specific budget and liability needs of your business.

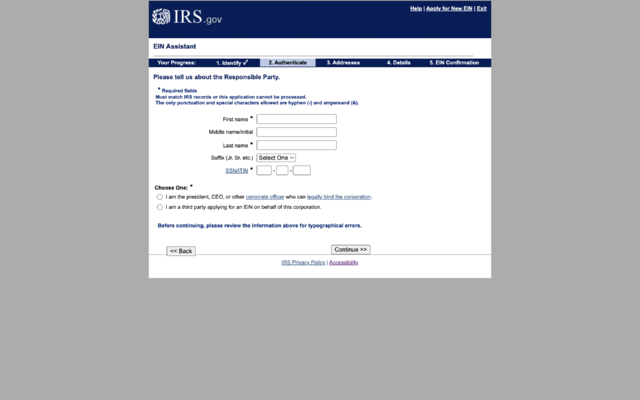

After choosing, you will be asked to confirm what you just entered. Then, the next screen will ask why you are requesting an EIN. If you enter “starting a new business,” you’ll be taken to a screen to enter your personal information.

Enter Your Personal Information  Enter Your Business Address

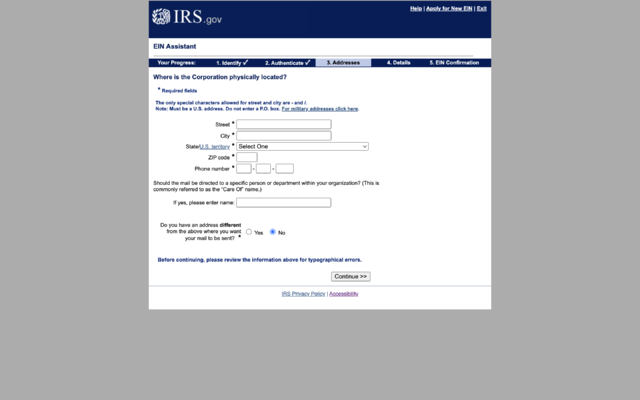

Enter Your Business Address

After you enter your personal information and your affiliation to the business, you’ll have to enter your business address.

Let’s pause here for a minute. This is important. For Fundability™, you MUST have a consistent, physical business address where you can receive mail. That may be your home, a virtual office, or another location. However, It should not be a P.O. Box or an UPS box. Consequently, if you ever change it, be sure you update the business address your EIN is linked to. The address needs to be consistent in all places.

The next screen asks for address verification. Sometimes, they will find your address listed slightly different in the database. Just choose how you want it listed. If the database is correct, I suggest using that one for the consistency mentioned earlier.

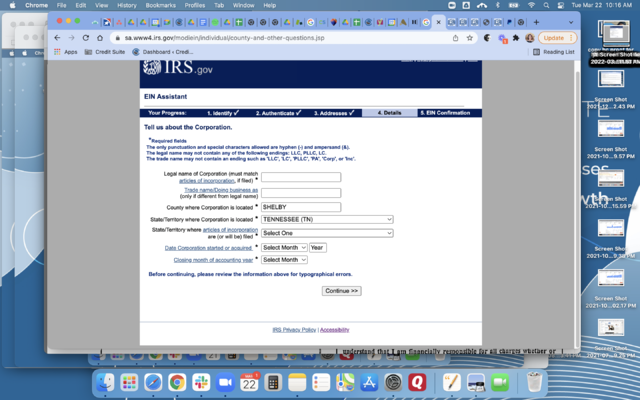

Lastly, enter the rest of your business details.

Enter Your Remaining Business Details

After that, you will get your EIN confirmation, if everything checks out.

When Can You Use Your EIN?

According to the IRS it can be used immediately for most of your business needs. These include:

- Opening a bank account

- Applying for business licenses

- Filing a tax return by mail.

Yet, it will take up to two weeks before it is part of the IRS’s permanent records. Until then you cannot:

- File an electronic return

- Make an electronic payment

- Pass an IRS Taxpayer Identification Number matching program.

It’s Not Hard

As you can see, the online process of applying for an EIN is pretty straightforward and fast. If you do not want to do it online, for whatever reason, there is a paper application that you can download, fill it out, and send in.

Of course, you can apply for an EIN anytime, but there are a few things that you can do first to make it easier to build fundability. For example:

- Settle business contact information so it will already be correct when associated with your EIN

- Ensure your business information is the same as it is everywhere else, down to the smallest ampersand

- Incorporate, or at least choose your legal structure

If something changes, just be sure you change it everywhere. Want to know more about the steps to building Fundability™, starting with a Fundable™ Foundation? Get a free business finance assessment now!