Are there any business credit cards that do not report to personal credit? Your business credit history can affect the terms you get for a future business loan. And it can affect your limits and what you will pay in interest.

So if you really don’t want your business credit card to report to even one consumer credit bureau, then read on.

Business Credit Cards That Report to the Personal Credit Bureaus

| Card Issuer | Reports Activity to Personal Credit | Reports all info on Personal Credit Report(s) | Reports on negative info on Personal Credit Report(s) | Reports to Business Credit Bureau(s) |

| Arco Fleet Card | No | No | No | Dun & Bradstreet

Equifax Experian |

| FairFigure Capital Card | No | No | No | Yes |

| MasterCard IO Card from Mercury | No | No (No PG required to apply) | No | No |

| PNC Cash Rewards® Visa Signature® Business Credit Card | May | May (PG is required to apply) | May | Dun & Bradstreet

Equifax Experian |

| Stripe Corporate Card | No | No (No PG required to apply) | No | SBFE |

| Uline Trade Credit | No | No | No | Dun & Bradstreet

Experian |

| Visa Card from Divvy | May | May (PG is required to apply) | May | Dun & Bradstreet

SBFE |

Business Credit Cards that Do Not Report Personal Credit:

- MasterCard IO Card from Mercury

- FairFigure Capital Card

- PNC Cash Rewards® Visa Signature® Business Credit Card

- Trade Credit from Uline

- The Stripe Corporate Card

- ARCO Fleet Card

- Visa Card from Divvy

1. MasterCard IO Card from Mercury

For startups in particular, because they have no (or very little) business credit, often personal credit is checked. But not so with this credit card.

Mercury only recently became a credit card issuer. Their IO card is a MasterCard. You can get an IO card with just $50,000 in a Mercury account.

Unlike a standard corporate credit card, Mercury is a pay-as-you-go type of card. They will not perform a credit check. Get 1.5% cashback. There is no annual fee.

Much like a secured credit card, this credit card’s balance is the same as the balance in your account. But they don’t see it as secured, rather, as more of a charge card, because you have to pay it in full every month. If you do so, then it is, in effect, a 0 APR credit card.

Mercury also offers a debit card. However (unlike with a comparable card from Credit Karma), currently you cannot use it to deposit money. They also offer a savings account.

Note: because Mercury’s main customer base is startups and e-commerce firms, where business credit tends to not be considered for financing decisions, this card does not report to any business credit reporting agency.

2. FairFigure Capital Card

The FairFigure Capital Card varies greatly from other business cards in a few unique ways.

The most important thing to highlight is that this is an EIN-only card. You don’t need a personal guarantee or a personal credit check to qualify.

As long as you have a business that’s been operating for at least three months and $2,500 in recurring monthly revenue, you can get your own FairFigure Capital Card.

But what’s worth mentioning here is that the FairFigure Capital Card isn’t like others on this list. It’s not a charge card, and it’s not technically a business credit card either.

Instead, FairFigure purchases your deposits at a reduced rate and provides funding directly to you. They also extend funding based on your monthly revenue. As you grow, you can expect to tap into more funding.

Some other perks include:

- Cash back with eligible vendors

- No deposit required to get started

- Flexible payback terms ranging from four to eight weeks

They maximize your credit-building efforts by reporting to Equifax Commercial, the SBFE, CreditSafe, and the FairFigure Foundation Report.

You can see how much funding you qualify for and sign up for the FairFigure Capital Card here.

3. PNC Cash Rewards® Visa Signature® Business Credit Card

With the PNC Card Rewards Visa, enjoy a 0% APR on purchases for the first 9 billing cycles following account opening. But there is a purchase and balance transfer APR of 14.74% to 23.74%, based on creditworthiness. This APR will vary with the market based on the prime rate.

There is also a late payment fee of up to $39 and you will be charged $39 if you go over your limit. There is a $0 annual fee.

Earn a $400 bonus when you open and use a new card. To qualify for this offer: Make at least $3,000 in eligible purchases, using your credit card account, during the first three billing cycles following account opening.

Purchases that are not eligible include traveler’s checks and getting cash at ATMs. Otherwise, there do not seem to be any eligibility restrictions on other business expenses.

If you enroll in Cash Flow Insight®, their Spend Analysis tool will automatically assign business categories to your posted PNC business credit card transactions.

This business card comes with Visa benefits like travel accident insurance and roadside assistance.

There does not seem to be any information on corporate credit reports, so it probably will not get onto your company credit report. But at least it won’t hit your personal credit report.

4. Trade Credit from Uline

The right card for your business might turn out to not be a physical credit card at all.

We write about Uline a lot, but there’s a very good reason—we feel they do a lot to help out small businesses. They are credit issuers offering starter credit.

It’s not a physical credit card. Rather these are net 30 terms. Qualifying for Uline is easier than it is for many other retailers.

To qualify for credit with them, you will need to have built a Fundability Foundation™. Your business must have its own bank account.

Uline prefers for a business to have a good credit profile with D&B, but this is not a requirement. The business address on the D&B website should match the Secretary of State (SOS) and IRS records.

Your application may get approval for net 30 at the time of order. Upon final review, the Uline Credit Department may change to a few prepaid orders, before granting net 30 terms.

Uline is the leading distributor of Shipping, Industrial, and Packing materials, Industrial, and Janitorial Products. A good 99.5% of Uline’s orders ship the same day, with no backorders.

They report to Dun & Bradstreet and Experian. Their info will be on your credit report with D&B, but not your personal credit reports.

5. The Stripe Corporate Card

With the Stripe card, you can get a card simply for having a Stripe account—no personal guarantee is necessary. It will not affect your personal credit score. This card has no annual fee.

Your credit limit isn’t even determined by personal credit. Rather, it is determined by your payment processing and bank history. As your business grows, your credit line can increase.

Because Stripe offers integration with business expense management and accounting software, you can get detailed information on expenses. You can also set spending controls, so you can distribute this card as an employee card.

There are some limitations on which industries they will work with. You won’t be able to get this card if yours is a cannabis business or a firearms business. And they will not work with a company that sells to various countries like North Korea.

However, they will work with crypto businesses.

Stripe will report your business loan history to the Small Business Financial Exchange. They use Dun & Bradstreet to access your business credit history from the SBFE.

You can also use Stripe for invoicing customers and billing clients for subscriptions. And you can use Stripe to integrate with Constant Contact, Capital One, Fiverr, and DocuSign, among many others.

6. ARCO Fleet Card

ARCO offers two separate fleet cards—and one is a branded MasterCard. The main differences between the two are that the MasterCard is accepted in more places and you can use it for fleet maintenance.

You can issue cards to employees with various controls like how much they can spend on fuel.

They will send payment info to your Equifax, Experian, and D&B credit report. There is no personal guarantee required, but you must have a business bank account.

Get net 10 or 15 terms for either, and net 7 for the ARCO card. You can get net 5 terms with the branded MasterCard. The first payment made to Arco when you have a Net account can take up to 90 days to hit your report. But after that, it reports monthly.

To qualify, you need a Fundability Foundation™ and must have been in business for at least two years. They would prefer to see a good D&B PAYDEX score of 80, an Experian business credit score of 76 or higher, and an Equifax business credit score of 556 or higher.

But if your corporation does not have good business credit, you can also offer a personal guarantee. You will need a personal credit score of 640 or better, and they will do a hard pull.

7. Visa Card from Divvy

We have been following this card issuer for some time now, and the usefulness of their card has only increased over time. Originally, they only reported to the Small Business Financial Exchange. But now, they also report to Dun & Bradstreet.

As a result, you can build business credit with a Visa card from Divvy. And because they report to the SBFE, Experian and Equifax can potentially get data directly. If Divvy ever starts to report to either or both, the mechanism for doing so is mostly in place already.

Earn rewards or statement credits, or get cash back. This is no annual fee for this credit card.

Like other credit cards we’ve showcased, you can get virtual cards, track employee expenses, and track transactions. This card integrates with several other finance apps, and it offers budgets with built-in spending controls.

If you are willing to settle for a lower credit limit or a more frequent payment schedule, you should be able to qualify for this small business credit card even with bad personal credit.

In addition, you can integrate accounts payable and accounts receivable with the Divvy software platform. Handle expense reimbursements through the platform, too.

How Business Credit Cards Affect Personal Credit

In general, the effect that a business credit card will have on personal credit will be positive. One of the factors in your personal credit score is your credit utilization. Plus, personal credit card limits tend to be lower than they are for small business credit cards.

Add to this the fact that company expenses tend to be on the high side, and you have a recipe for overuse—which can lower your personal credit scores.

As a result, keeping business expenses off your personal credit cards is an important goal to have. Utilization does not have anywhere near as much of an impact on company credit scores.

Hence if expenses move over to your small business credit cards—where they rightfully should be—then your personal credit scores should rise or at least be prevented from falling.

For both types of credit, the organization is key, so you keep up with your payments and maintain a good credit history. Keeping these expenses separate helps with this kind of organizational need.

As a bonus, the Internal Revenue Service would prefer for you to have separate accounts anyway. You can lower your chances of being audited and, at the same time, make your business and personal taxes easier to do.

Is it Worth Getting Business Credit Cards that Do Not Report to Personal Credit?

Absolutely! But there’s a caveat. If the card issuer does not report positive payment experiences to the business credit bureaus, then it may be a useful credit card for other purposes, but it’s not doing as much for you as it could.

Building business credit should always be your ultimate goal with a business credit card. This is because corporate credit can help you:

- Qualify for more and better types of financing and credit

- Get better payment terms with your own suppliers

- Weather difficult economic times because you can buy now and pay later

- Leverage it to take advantage of lower-priced supplies and raw materials and buy in bulk

- Add to the value of your small business if you ever wish to sell it or will it to someone

Since you already have to pay for goods and services for your business, it makes sense to have your payments serve you in multiple ways.

Building business credit is not an end in itself. Rather, it is a means to an end. Small business owners should squeeze as much value out of every penny that they can. And having a card that reports to the business credit bureaus is one way to do just that.

Takeaways for Business Credit Cards that Do Not Report to Personal Credit

Business expenditures can do more for your business than just getting you the goods and services that you need.

If you use a business card that reports to the business credit reporting agencies rather than the personal ones, then filling a company vehicle with gas and paying that bill on time will directly raise your business credit scores.

Contact us today to learn more about how to get the most out of business credit and business credit cards.

FAQs

Can You Build Business Credit Without Using Personal Credit?

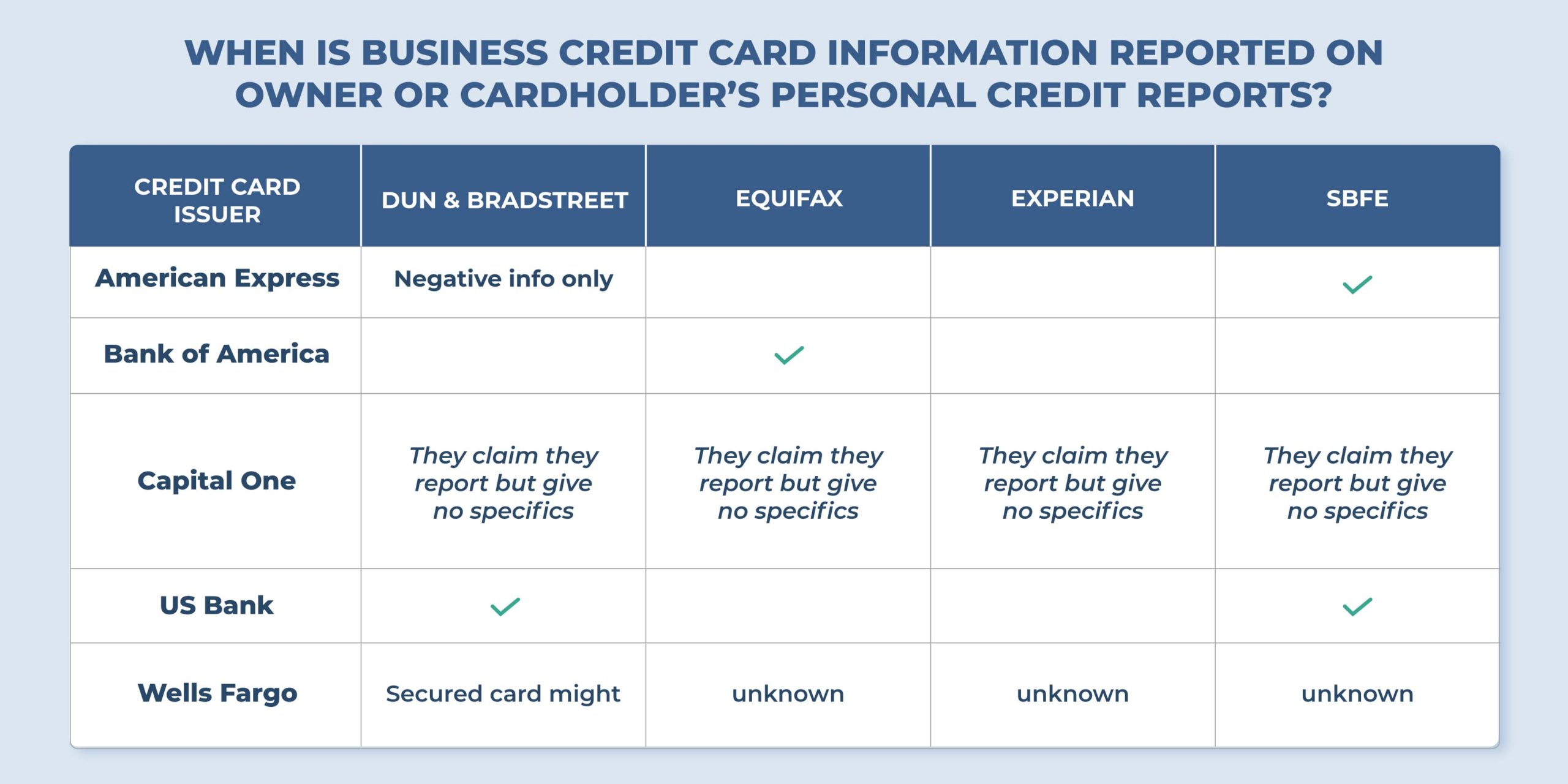

Yes, it is possible. While FICO SBSS and Experian will both use personal credit when figuring out your business credit scores, D&B and Equifax will not. Dun & Bradstreet is a significantly larger credit report agency than the others.

Finding business credit cards that do not add payment data on your Experian small business credit report, and for your business can qualify for can be a daunting task. After all, the best business credit card is always going to be the one that you can get.

At Credit Suite, we make it our mission to know which credit cards report, and where. We know the details of how you can qualify, and how you can update your business information if it’s lacking in any way—so you can get the best credit card for your company.

Do Business Credit Cards Show On Your Personal Credit Report?

Not necessarily. You will need to be careful when selecting a business card. Beyond rates and fees, and benefits, you should also be mindful of where a particular credit card will add payment experiences to your report.

If you need a particular credit card but have to provide a personal guarantee, then that will result in a hard inquiry on your credit. A few hard inquiries all at once will lower your personal credit score.

This is why we advise building a Fundability Foundation™ so that there are more reasons for a credit issuer to say yes, preferably without performing a hard inquiry.

Is Business Credit Linked to Personal Credit?

In some ways, yes. For example, both Experian Business and FICO SBSS calculate your company credit score, in part, from your personal credit scores. This is so regardless of whether you use an EIN to apply for credit, or not.

Equifax and Dun & Bradstreet do not use personal credit in their calculations.

However, recognize that many applications will call for a Social Security number for each owner (often for owners with at least a 20% or 25% share in the business). This is done for identification purposes, and not necessarily for the purpose of conducting a personal credit check.