Yes, You Can Get Credit for Your Business without a Personal Guarantee

Your business needs credit but everywhere you turn, lenders want a personal guarantee. It’s frustrating, isn’t it; to go where to establish business credit but it turns out they still want to rope your personal spending habits and assets into the mix. You want, and need, credit without a personal guarantee.

Lenders, creditors, and banks don’t do this to make your life harder. Rather, they do it because they know where to check a business credit score, and your company’s has been found wanting. Or maybe your business is new and you have not yet established what lenders see as a good business credit score.

You can fix this in a few steps. However, you will need to have patience as this may take a while. Fortunately, time is often on your side, particularly if you pay your bills on time.

Every Business Needs to Establish Small Business Credit Without a Personal Guarantee

Company credit is credit in a small business’s name. It doesn’t connect to an owner’s individual credit, not even when the owner is a sole proprietor and the only employee of the business.

As such, a business owner’s business and individual credit scores can be very different. Getting business credit without a personal guarantee helps to assure they stay separate.

But First, What’s a Personal Guarantee?

A personal guarantee essentially undermines your task to build business credit. Now, when you are first starting out, you may be stuck offering these, at least for a while. But you need to try to go without a personal guarantee as soon as you can. Why?

Because a personal guarantee means you are personally liable if your business goes bankrupt. And considering that some 90% of all new businesses fail within the first five years, a PG could easily devastate your savings and cost you your home. So no matter what, try to go without a personal guarantee.

And if you absolutely must provide one, be sure there’s a clause in the agreement whereby the PG will be lifted once certain conditions are met. Often, that has to do with what percentage of debt you’ve paid off.

The Advantages of Building Business Credit Without a Personal Guarantee

Because small business credit is independent from personal, it helps to secure an entrepreneur’s personal assets, in the event of legal action or business insolvency.

Also, with two separate credit scores, a business owner can get two separate cards from the same merchant. This effectively doubles purchasing power.

Another advantage is that even startup companies can do this. Visiting a bank for a business loan can be a formula for frustration. But building company credit, when done correctly, is a plan for success.

Consumer credit scores depend upon payments but also various other factors like credit use percentages.

But for business credit, the scores truly just hinge on if a small business pays its bills on a timely basis.

The Process of Getting to Business Credit Without a Personal Guarantee

Growing small business credit is a process, and it does not happen automatically. A company must actively work to build business credit.

That being said, it can be done easily and quickly, and it is much speedier than establishing consumer credit scores.

Vendors are a big component of this process.

Undertaking the steps out of order will lead to repetitive rejections. Nobody can start at the top with small business credit.

Small Business Fundability™

A small business needs to be fundable to loan providers and vendors. This is one very big thing they will look to when you’re trying to go without a personal guarantee.

Due to this fact, a small business will need a professional-looking web site and email address. And it needs to have website hosting bought from a vendor such as GoDaddy.

Additionally, business telephone numbers should have a listing on ListYourself.net.

Also, the company phone number should be toll-free (800 exchange or comparable).

A small business will also need a bank account dedicated solely to it, and it has to have every one of the licenses necessary for operation.

Licenses

These licenses all have to be in the exact, appropriate name of the company. And they must have the same company address and phone numbers.

So bear in mind, that this means not just state licenses, but possibly also city licenses.

Working with the IRS

Visit the Internal Revenue Service web site and get an EIN for the small business. They’re totally free. Pick a business entity such as corporation, LLC, etc.

A company can get started as a sole proprietor. But they should switch to a type of corporation or an LLC.

This is in order to limit risk. And it will make best use of tax benefits.

A business entity will matter when it involves tax obligations and liability in the event of litigation. A sole proprietorship means the entrepreneur is it when it comes to liability and tax obligations. Nobody else is responsible.

Starting Off the Business Credit Reporting Process

Start at the D&B web site and obtain a totally free D-U-N-S number. A D-U-N-S number is how D&B gets a company into their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s sites for the company. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process.

In this way, Experian and Equifax will have something to report on.

https://creditsuite.wistia.com/medias/x7ls7b9r9y?embedType=async&videoFoam=true&videoWidth=640

Vendor Credit

First you ought to establish trade lines that report. This is also known as vendor credit. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can get more credit.

These varieties of accounts tend to be for the things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

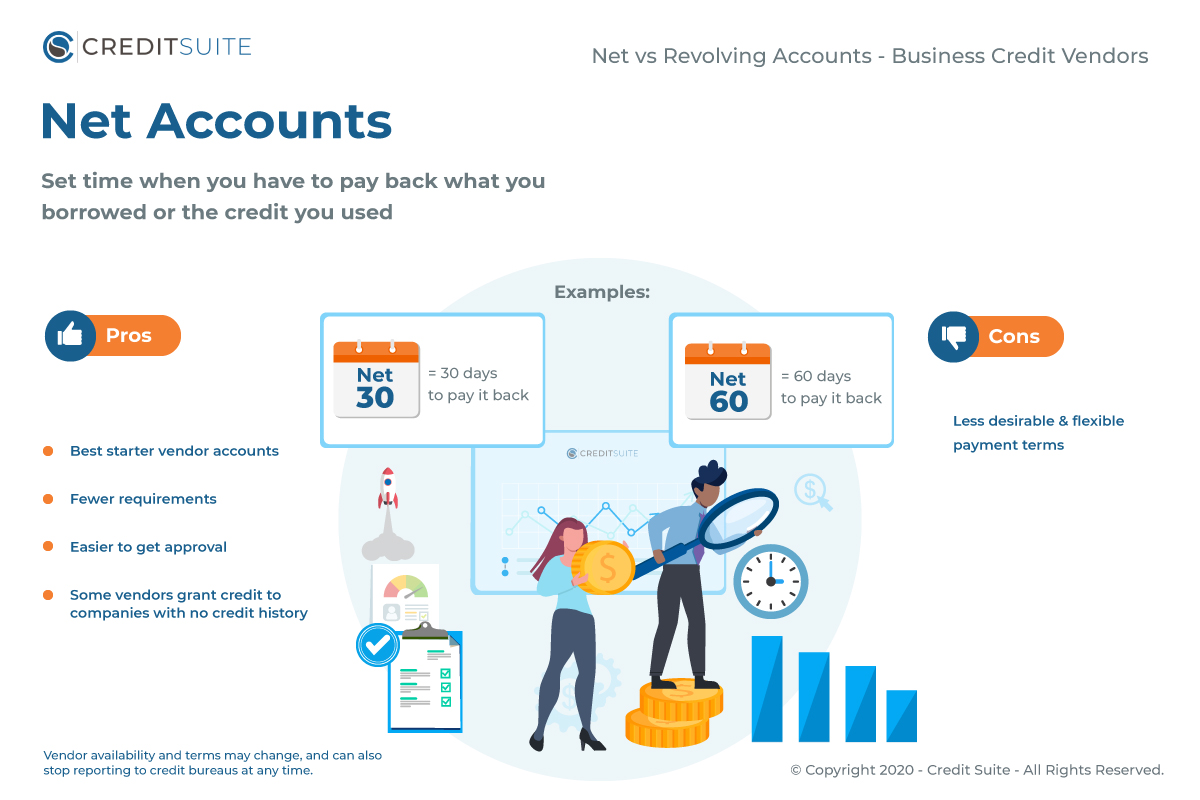

But to start with, what is trade credit? These trade lines are credit issuers who will give you initial credit when you have none now. Terms are ordinarily Net 30, versus revolving.

Therefore, if you get an approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, such as within 30 days on a Net 30 account.

Details

Net 30 accounts need to be paid in full within 30 days. 60 accounts must be paid in full within 60 days. In comparison with revolving accounts, you have a set time when you must pay back what you borrowed or the credit you made use of.

To begin your business credit profile the right way, you need to get approval for vendor accounts that report to the business credit reporting bureaus. When that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Vendor Credit – It Makes Sense

One of the beauties of vendor credit is you can often go without a personal guarantee.

Not every vendor can help in the same way true starter credit can. These are merchants that will grant an approval with nominal effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You want 3 of these to move onto the next step. Here are some stellar choices from us: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and attend to any errors as soon as possible. Get in the habit of taking a look at credit reports and digging into the particulars, and not just the scores.

We can help you monitor business credit at Experian, Equifax, and D&B for 90% less than it would cost you at the CRAs.

Fix Your Business Credit

Disputing credit report mistakes typically means you specifically spell out any charges you contest.

Dispute your or your small business’s Equifax report by following the instructions here.

You can dispute mistakes on your or your company’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.

And D&B’s PAYDEX Customer Service contact number is here: www.dandb.com/glossary/paydex.

A Word about Building Business Credit Without a Personal Guarantee

Always use credit responsibly! Never borrow more than what you can pay back. Keep track of balances and deadlines for payments. Paying off on schedule and fully will do more to increase business credit scores than just about anything else.

Establishing small business credit pays off. Good business credit scores help a business get loans. Your loan provider knows the business can pay its debts. They understand the company is bona fide.

The business’s EIN connects to high scores and loan providers won’t feel the need to require a personal guarantee.

Takeaways for How to Get Business Credit Without a Personal Guarantee

Business credit is an asset which can help your business in years to come. Go without a personal guarantee as fast as you can. Learn more here and get started toward growing business credit.