If you’ve ever thought about small business credit cards, then you’ve most likely pondered what the most common business credit card requirements are.

While requirements will change from credit card issuer to card issuer (with stricter requirements for a business platinum card or ultimate rewards cards), there are some predictable constants.

Who Can Apply for a Business Credit Card?

For a small business to be able to get a small business credit card, the applicant will need to be someone with an ownership interest. Much of the time, this works out to 20% or 25% or better.

They will need to check requirements closely, from any provider, like Capital One or Mastercard International Incorporated or the like. What is the annual fee, if any? What sort of small business credit score do they need, if any?

Is there a balance transfer fee? Are there rewards? And if so, what is the reward rate? Do you have to make a certain kind of eligible purchase to get rewards? Are any business expenses excluded? Are there cash rewards?

Can you get a separate employee card from this card issuer? Does this card issuer offer gift cards in lieu of cash or rewards? Can you get a business line of credit with this small business credit card?

Does this credit card company allow an applicant with a bad credit history to attain a card membership? If not, then what’s the minimum credit score they will allow?

Between the annual fee and rewards from this business card, is it worth it to pay for business expenses with it? Can you potentially pay an annual fee from business card rewards?

Business Credit Card Requirements

Here are some of the most common business credit card requirements, regardless of credit issuer, whether it’s Capital One or a national bank or any other credit issuer. The best business credit card for you will undoubtedly come with qualifications.

A Separate Business Entity With an EIN

A credit card will have to be issued to someone. If your small business is not incorporated, then it cannot have its own credit cards. As a result, the card will be issued to you. And then it really won’t be a business credit card.

Can business owners use an LLC? Yes, it is possible. But keep in mind that the IRS will treat an LLC like a corporation under only certain circumstances. You will need to proactively fill out IRS form 8832 to be sure your LLC is treated the right way.

While you’re on the IRS website, be sure to apply for an EIN as well. This is an identifying number for a small business that works like your Social Security number works for you. Card issuers will virtually always ask for one, so get it as soon as you can.

Incorporating (and you can be incorporated yet still have an LLC) truly creates a separate entity. This can help you with liability, too, and with getting card issuers do not lean on your personal credit as much when deciding on approvals.

There are card issuers that will not approve cards for anything other than a corporation or an LLC.

The Ability to Create a Business Credit History, Credit Score, and Report

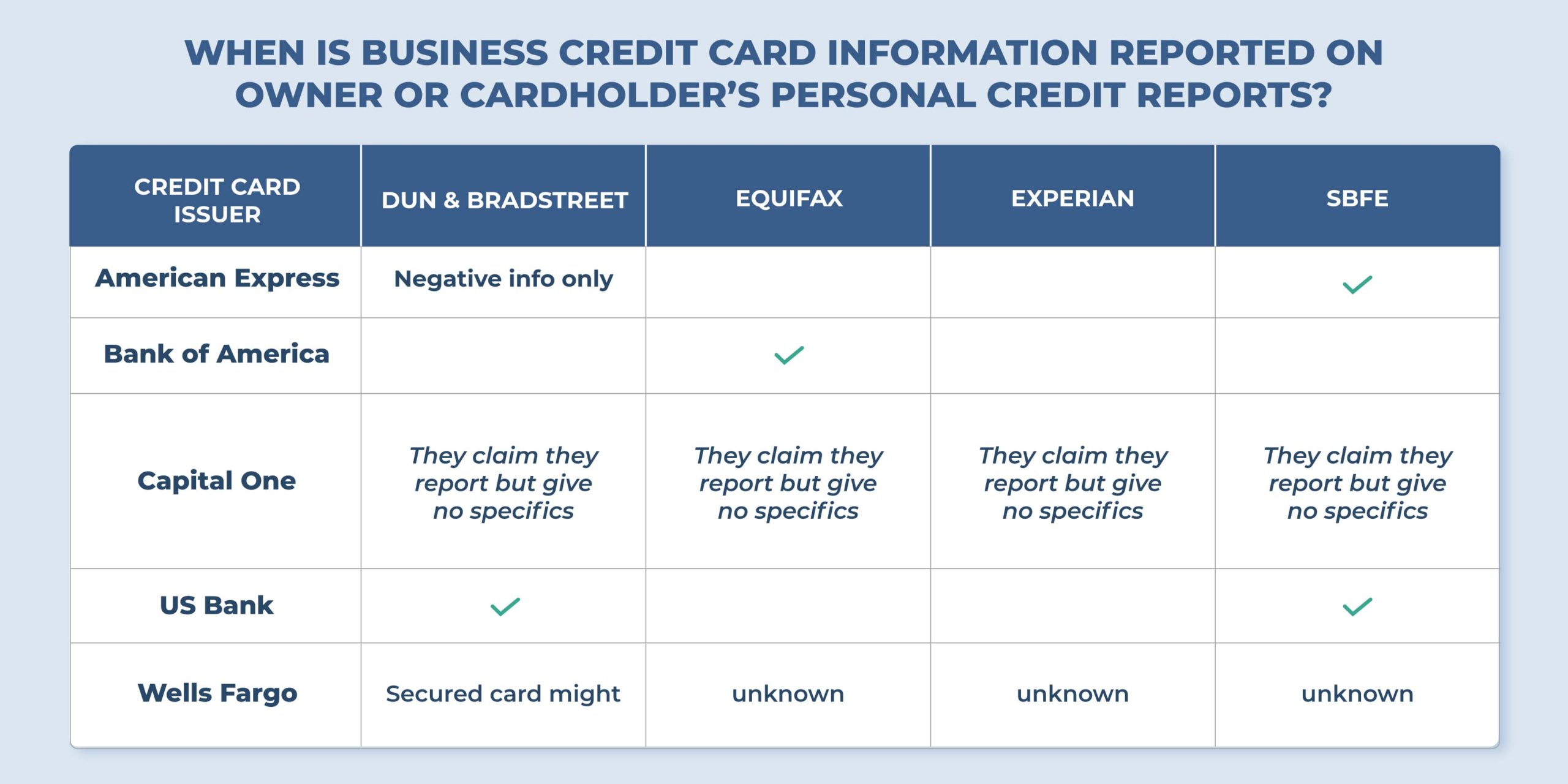

If your small business does not have any records with any of the business credit reporting agencies, then where will your small business credit card payments (or defaults, for that matter) be reported?

If your small business does not have any records with any of the business credit reporting agencies, then where will your small business credit card payments (or defaults, for that matter) be reported?

Business owners can get started by applying for a D-U-N-S number from Dun & Bradstreet. If you don’t mind waiting, a D-U-N-S number costs you no cash.

While not every business credit card application will ask for one, a D-U-N-S is how you can start building your business credit score. Experian and Equifax will follow suit, once you start to get a PAYDEX credit score from D&B.

And keep in mind, even though Experian and Equifax report both personal credit and business credit, neither one will transfer any of your transactions from personal credit to business. Getting a D-U-N-S number in advance is your best bet.

That way, you wouldn’t be wasting your time with what would be a personal credit card, even if it had your business name on it, and even if you were using it exclusively for business expenses.

So, get the D-U-N-S first, before the account opening date. Because getting what looks like a business card, but really isn’t one, is just a waste of time and cash.

A Separate Business Bank Account

Get a business credit card. Pay its bills with the cash in your business bank account. Simple, no?

Don’t like to go to a big bank? You don’t have to. Online banking can work just fine. A business owner doesn’t even have to leave their couch to open a bank account.

With many business credit cards, the application calls for a separate business bank account. So, you’d best be prepared before you apply.

Or business owners can do it in reverse order, and get a bank account for their businesses before applying for a business credit card. In particular, a bank may be more inclined to offer you its best credit card if you already have a good record and relationship with them.

A business bank account is also useful if your rewards come in the form of a statement credit. Imagine getting such a credit from, say, a business platinum card. If you used this credit card a lot, you could save cash and end up with a lot of your bills already paid.

A separate business bank account is also useful at tax time. The Internal Revenue Service does not want you commingling cash. Having a separate account means your personal bank statement won’t show something like a foreign transaction fee.

A Decent Personal Credit History

How much is decent? Probably at least 660 in personal credit. Of course, check the requirements for any specific business credit card you’re trying to apply for.

A decent personal credit score does not just have its own rewards. Rather, it is also a portion of your Experian and FICO SBSS credit score. Improving your personal credit score will raise these scores as well.

The best way to improve your personal credit score is to:

- Pay your credit card bills on time

- Don’t apply for too much credit at once

- Don’t close old credit card accounts, even if you never use them

- Keep your cash spending in check and do not use more than about 25 – 30% of your available credit

- In line with the last suggestion, try not to have cash amounts owed that are too high

Business credit issuers will look at your personal credit because it gives them a good sense of how likely you are to pay your business credit bills on time.

Even if you get a business credit card unattached to your personal credit, they are still likely to be interested in your personal credit score. It is just too helpful a metric for them to ignore.

Consistent Business Information Everywhere

Perfect consistency in your business information is vital. But why? And, just what does consistency really mean?

Imagine your company is named Smith and Co., Inc. Let’s also assume that you did not incorporate until your business was two years old.

Maybe a contract web designer misspelled your company name as Smyth and Co. Or maybe you were in a hurry when you were applying for a business license and wrote it as Smith & Co.

Perhaps you didn’t get an office until after you were incorporated and so your Google My Business Listing includes “Inc.” but other records do not. Maybe you opened a Dun & Bradstreet account as Smith and Company, Incorporated. You get the idea.

A lender or business credit issuer is not going to stop and think of all the myriad ways your business could be designated. Instead, they will deny your application, and mark it as fraud.

While that may feel harsh, fraud runs rampant and lenders and credit issuers must protect themselves. But at least this is a relatively easy thing to fix.

Keep records of where your business is listed—your website, the Secretary of State’s office, etc. and start fixing them if necessary. Copy/paste this information to make it easier to get it perfectly right.

All Applicable Licensing

Licensing can be a requirement from any number of government entities. Your state is far from alone. Your county, city, or industry may require it. You may need different licenses (or at least variants) for doing business out of state.

Always check with your Secretary of State and your local government to see if your profession requires licensing.

Many business credit card issuers, particularly those for starter vendors, will require that you have all the necessary licenses. Starter vendors tend to be more diligent simply because they have few other touchstones to show that your business will survive.

But businesses with some years in them have a greater chance of survival and are less likely to only be looking to get a credit card from a starter vendor.

Why are business licenses so vital? It’s because they are good evidence that you are serious about your small business because you’ve put down cash.

In Massachusetts, for example, a massage therapist’s license runs $225. In Iowa, a private investigator must be licensed, pay a fee of $140 in cash, and also provide proof of a $5,000 surety bond. A two-year real estate license in Texas costs $185.

Beyond getting a business credit card, licensing has two major benefits/rewards:

- A business owner can avoid potentially paying any penalties for not being properly licensed

- It can be a selling point to customers and prospects

A Completely Filled-Out Application

Perhaps this seems self-evident, but without an application, you will not get a business credit card. Filling out the application, in its entirety, can only help you.

Always check requirements closely. If an application requires that you attach, for example, proof of two years’ worth of annual business revenue, then you will need to do so.

And if you do not have proof of two years of annual business income (say, yours is a newer startup), then it will be a waste of time for you to fill out the application at that time. But you can always revisit it later, once you have the information that the credit issuer is seeking.

And do not be discouraged if your application is rejected! There may be a better chance of qualifying if you apply in person, or over the phone. Both of these options give you a chance to explain anything that may be confusing to a credit issuer.

But no matter how you fill out the application for a business credit card, a small business owner should assume that every section of the application is mandatory—unless it is expressly spelled out that a particular section or question is optional.

Takeaways

A business credit card can be yours if you take the time to address all requirements head-on before you even get to see the application.

Contact us today if you need help with business credit building, another factor that will help you get more business credit card approvals.