8 Ways Sole Proprietors and Freelancers Can Build Business Credit

Did you know that the entrepreneurial market and the gig economy have accelerated since the pandemic? But as a business owner or bonafide freelancer, have you thought about establishing your business credit?

You might have been well-acquainted with personal credit all your life. And you do what it takes to maintain a good credit standing. But in the business realm, you also need to stay on top of your business credit. That is, if you want to seek funding, secure a loan, or make an investment.

Fret not; This page is dedicated to sole proprietors and working freelancers looking to establish their business credit. Earn some practical tips on how to build your credit and kick it up a notch.

Read on.

How To Build Your Business Credit as a Sole Proprietor and Freelancer

Startups have boomed since the pandemic outbreak. A whopping 99.9% of all business entities in the United States are small businesses. And most of them are owned by sole proprietors.

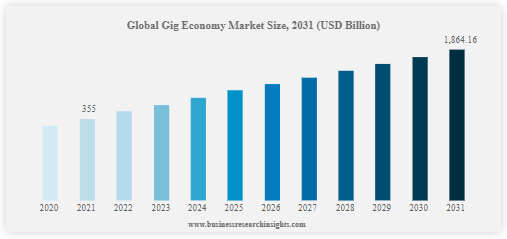

Meanwhile, the gig economy has thrived as well. Many individuals have ventured into the freelancing world as a contractor. The proof is in the numbers:

The global gig economy market could exhibit a 16.18% compound annual growth rate (CAGR), potentially hitting $1,864.16 billion in 2031 from only $355 billion in 2021. See its market growth in the clear graph below.

However, there’s a need to build your business credit, whether you’re a sole proprietor or a freelancer treating your work as a business.

In a nutshell, a business credit is a measure of your company’s creditworthiness. The score is a reflection of its financial health. This implies your capability to pay any business loan as a business owner and how high or low your financial risk is.

Here’s the good news, though: various hacks for increasing your credit score are all at your disposal. It’s just a matter of earning some practical tips and executing them. But of course, as a novice freelancer or sole proprietor, you’ve got to build your business credit first.

Don’t know how to get started? Here’s how:

1. Register To Get Your Business Onboard

Sure, you can kick off your business venture under your personal name as a sole proprietor or a freelancer. However, it’s better to register your startup as a business entity.

Not only does it guarantee business protection and even tax deductions, but this registration also triggers your business credit. That is when you start opening a business account, applying for a credit card, or getting a business loan.

But of course, you must decide which business entity is suitable for you. Consider the following:

- Sole Proprietorships: You can either be a single-member LLC or a sole proprietor. Your startup or small business essentially falls under your name.

- Business Partnerships: The business is obviously owned by two or more individuals sharing capital, assets, and skills. Limited liability partnerships and limited liability companies fall under this category.

- Corporations: The corporation consists of several shareholders sharing capital and receiving dividends from the business profits. It can either be a C or S Corporation.

2. Get the Numbers in, whether DUNS or EIN

Are you looking to get your business credit rolling? Instead of savoring the benefits of napping and doing nothing at all, consider securing the pertinent numbers for your business.

As a sole proprietor or freelancer, business identifiers can make a difference in your business credit. That said, here are key numbers to secure for your business:

- Data Universal Number System (DUNS): No, this number isn’t necessarily required for businesses that are up, running, and fully operational. However, consider applying for DUNS from Dun & Bradstreet. Why? It is the most popular bureau, heavily relied on by creditors.

- Employer Identification Number (EIN): The EIN is precisely what it is—a business identifier. You better secure this number if you’re looking to establish your business credit. Why? Most creditors and lenders ask for this number for various applications, whether loans or credits.

3. Draw the Line between Your Personal and Business Finances

Your personal or business finances can trigger, build, and affect your business credit. However, let’s debunk this common misconception:

- You don’t need business credit if your personal credit score is good. Yes, you can capitalize on business loans with remarkable personal credit. However, having a business credit won’t mess up your personal credit and will give you access to several funding options. Plus, better loan terms and rates are at your fingertips!

That explained, what better way to build your business credit than to set it apart from your personal credit?

Linda Shaffer, Chief People Operations Officer at Checkr, recommends separating personal and business finances. “They are two different aspects of your life, albeit intertwined. But to keep things organized, never mix up your personal and business accounts. You don’t want your personal credit to mess up with your business credit—or the other way around.”

4. Tap into the Vendor or Supplier Credit

Have you heard of the buy-now-pay-later scheme in business? Of course, you did. This scheme applies to third-party vendors or suppliers for various businesses across different industries.

These providers allow you to procure the materials or hire the services you need. Then, you can pay for them later, usually after 30, 60, or 90 days. Check the following examples:

- Supplier Credit: Suppose you’re receiving your raw material supplies every month. In this case, your supplier lets you pay after a month to three months.

- Vendor Credit: Let’s take, for instance, you’re working with third-party service providers. They let you pay for the services you received after a month or so.

Vendor or supplier credit can help you build your business credit. How? They let you pay in a certain period of time and report to the credit bureaus. However, make sure you are paying on time so that your payments will reflect positively on your credit report. That can give you a high credit score you deserve!

Note: You can resort to vendor accounts if you have yet to build your credit. They can help you set your credit on the right footing. Then, you can maintain it in the long run.

5. Pay Your Bills or Debts on Time

Jim Rainey, VP of Growth at CoPilot Search, highlights the value of timely payment for business credit. “Yes, lenders or creditors let you borrow money or gain capital. However, the rule is simple: pay them on time. That way, they can report your timely payments to the credit bureaus, and you can start building your credit in a positive light.”

But settling financial obligations on time is easier said than done. But as a sole proprietor or freelancer, here are some best practices for you:

- Stay on top of your payments. Whenever possible, pay them on or before the due date. A late or delinquent payment is a big no-no!

- Mark the calendar and set reminders. As a business owner, you’ve got a lot of things going on in your mind. Schedule them so you won’t forget!

- Consider having autopay. Consider applying for recurring payments. That way, your payments will automatically be deducted from your bank account. You won’t miss out on your financial responsibilities!

- Set an emergency fund in place. Every business should have this since emergencies can strike anytime. For instance, consider securing payment bonds for financial and legal protection in case of your inability to pay contractors.

- Know your priorities. Know what to prioritize in your list of expenditures. And what better way to pay on time than to budget your business finances?

6. Keep Your Revolving Line of Credit Low

As a sole proprietor or freelancer, you might have started getting lines of credit. However, know when to dip into your line of credit. Only do so during unexpected emergencies, for equipment repairs, during peak seasons, or when ramping up your business. This move can affect your business credit along the way.

So, when building your business credit, here’s how to maintain your line of credit:

- Make informed decisions on credit terms. Know the rates and fees associated with them so that you can settle your financial obligations promptly.

- Use your credit only when necessary. Tap into your credit for your business during emergencies only, like when you need to repair your equipment, launch a new product, or expand to a new market.

- Keep tabs on your credit usage. It’s best to monitor your credit every now and then. That way, you can control how you use it and spend it on things.

- Pay the outstanding balance in full. If possible, don’t just pay for the monthly minimum. Try to settle the total amount you’re responsible for.

7. Keep an Eye on Your Business Credit Score

The last on the list is the most crucial part of building a good business credit standing. There’s no better way to stay on top of your credit than to monitor it. This means regularly obtaining a copy of your credit report from these credit bureaus:

- Dun & Bradstreet: As mentioned, it’s the most popular credit bureau. It is solely dedicated to businesses with a PAYDEX 100-point score system.

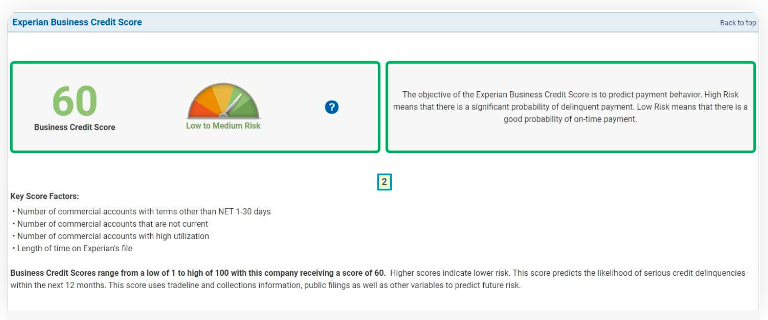

- Experian: It’s well-known as a personal credit bureau. However, it also caters to businesses assigning a score of one to 100.

- Equifax: Same as Experian, Equifax reports personal and business credit. It assigns three types of scores: 1 to 100 (timely payments), 101 to 992 (late payments), and 1,000 to 1,080 (delinquent payments).

- FICO SBSS: It stands for FICO Small Business Scoring Service (SBSS), assisting financial institutions in their lending decisions. A good score for them is between 140 to 300.

But while at it, find ways and means to boost your credit score real fast. Start by understanding the factors affecting your business credit score:

- Credit Information: Consider your credit type and capacity. Likewise, pay attention to your payment history and credit utilization. More importantly, strive to maintain healthy payment habits.

- Public Records: Ensure you maintain a clean public record. Avoid UCC filing, liens, legal filings, and accounts in collections and bankruptcies.

- Business Backgrounds: Factor in your business niche, type, and size. Also, consider the years on file, your business financial data, and the standard industrial classification (SIC) code.

Final Words

The entrepreneurial world and gig economy have allowed people to make more money since the pandemic. Not only have they let them generate more income, but these segments have enabled them to build their business empire. That’s when business credit comes in as part of the overall equation.

That said, consider the practical tips above for building your business credit. As a business owner or a working freelancer, your credit score mirrors your creditworthiness. It reflects your financial capabilities, which translate to business opportunities. It lets you gain huge capital, secure favorable loans, and make significant investments.

Build and maintain a good credit standing, and that can make a world of difference in your business opportunity or freelancing work!