Please note: Lending options, rates, and qualifications change regularly. The information in this post is based off of requirements as of original posting date of July 2, 2024.

Securing a $400,000 loan for your business signifies a significant achievement, and our article is prepared to assist every step of the way. Selecting the appropriate loan is crucial, as every financing choice comes with distinct stipulations.

As with all types of lending, you need to reach different requirements with the proper Fundability in order to fully qualify. This article is giving you the information you need to understand the starting points for some of the most common types of funding available. Additionally, it’s important to keep maximum approval amounts in mind when searching for funding. You will find each one we touch on in this article have a wide range of maximum limits. But with the correct combination, you have the possibility to reach those funding needs and wants much easier.

The table below has the requirements for each major business loan type.

The Best $400k Business Loans

| Loan Type | Requirements | Approval Difficulty |

| Bank Loan (Term Loan) | Good credit, 2 years in business, business cash flow | Hard |

| Business Line of Credit | Good credit, 2 years in business, business cash flow | Hard |

| SBA Loan | Good credit, 2 years in business, business cash flow | Hard |

| Credit Line Hybrid | Good credit | Easy (No Doc) |

| Business Credit Card | Good credit | Easy |

| Equipment Financing | Good credit | Easy |

| Merchant Cash Advance | Credit card sales, bad credit | Easy |

| Cash Flow Financing | Business cash flow, fair credit | Easy |

How to Qualify for a $400,000 Business Loan

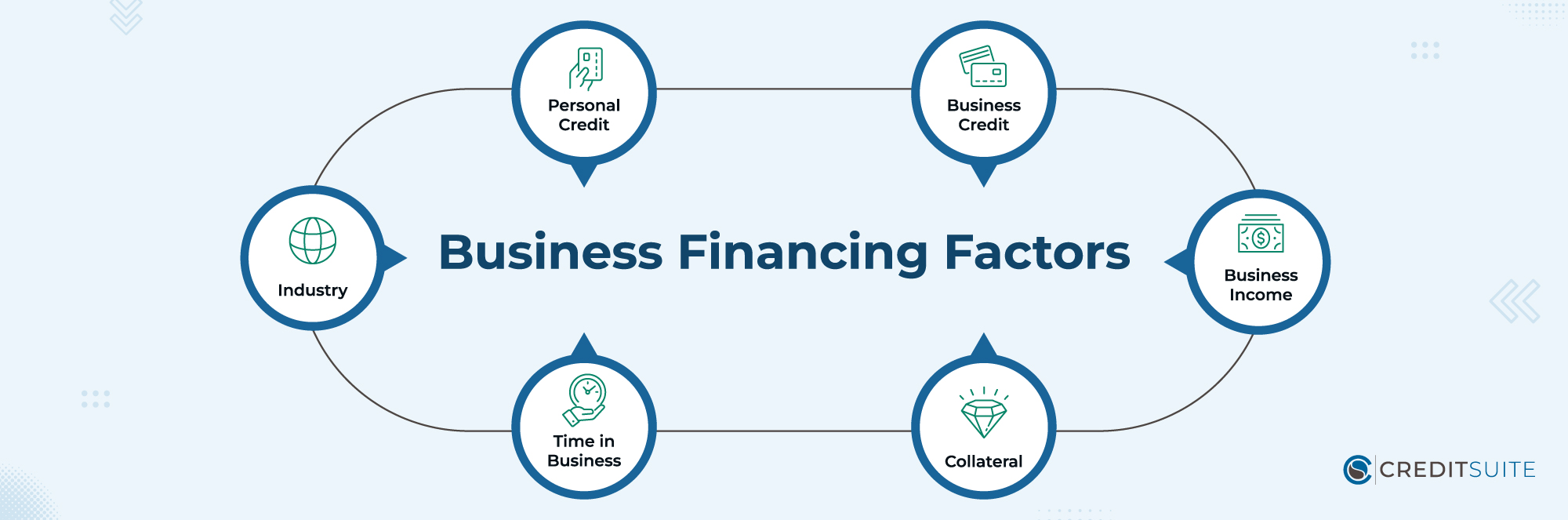

Obtaining a business loan depends on six essential elements. Conventional bank loans require mastery in these areas, whereas alternative funding routes may offer more flexibility. These critical components include:

- Personal Credit: Several dedicated financiers focusing on small businesses typically require entrepreneurs to possess solid personal credit rankings.

- Business Credit: Establishing strong business credit scores and elaborate profiles can streamline the loan approval process.

- Business Income: In business financing, most funding methods often need income proof as a basic requirement.

- Collateral: Securing authorization for loans secured by assets, like car loans, business real estate mortgages, and equipment financing, usually entails more streamlined procedures.

- Time in Business: The majority of business lending institutions generally prefer to deal with companies that boast a history of two to three years.

- Industry: Despite having a stable financial base, specific industries might face hurdles in obtaining approval.

The Best $400k Business Loan Types

Bank Loans (Term Loans)

Business loans from traditional banking institutions frequently go by the term “term loans.” This involves periodic repayments across a designated “term,” usually spanning 3 to 5 years. This type of financing commonly features steady interest rates.

Requirements: For eligibility for bank term loans, business owners usually need a robust personal credit history (FICO Scores above 680), an enterprise active for at least two years, and annual sales surpassing $100,000.

Business Line of Credit

Obtaining approval for business lines of credit, comparable to term loans, is typically offered by standard banks. Though the interest rates might be enticing, the prerequisites for eligibility can be stringent.

Once approved, you gain access to a loan that functions similarly to a credit card, providing flexibility for multiple uses. A specified credit limit, suppose $400,000, is assigned, and phased payments are necessary to resolve the remaining balance.

Requirements: To be eligible for business credit lines, owners of small businesses typically need a strong personal credit background (with FICO Scores exceeding 680), at least two years of running the business, and annual earnings over $100,000.

SBA Loans

Combining support from traditional banks with government guarantees, SBA Loans offer favorable terms and lower interest rates. However, the process of getting approved for these loans can be difficult.

There are a variety of SBA loan programs available, with the 7a and 504 loans being the most popular selections.

Requirements: For SBA loan eligibility, companies often must show a year of business activity, strong personal credit, and achieve specific income criteria.

Credit Line Hybrid

Credit Suite offers a novel approach dubbed the Credit Line Hybrid, facilitating swift authorization for business loans from $10,000 to $150,000, with only a few documents required.

Requirements: The Credit Line Hybrid requires a commendable personal credit rating (FICO 680 or higher). Startups lacking a track record, assets, or significant cash reserves can still apply, making the application procedure less complex.

Business Credit Cards

Business credit cards open up a new path for financial aid, with easy-to-achieve eligibility requirements. Functioning similarly to personal credit cards, they provide a credit facility that demands monthly settlements.

The key variance between business and personal credit cards is the often greater credit capacities offered to businesses. Furthermore, establishing a business credit profile helps entrepreneurs access these cards without having to rely just on their personal credit records.

Requirements: Usually, business credit cards demand a strong personal credit history, and sometimes, they might assess the business’s income.

Equipment Financing

Securing equipment financing provides a simpler route to qualification than alternative methods. It involves establishing either a loan or lease arrangement with regular monthly installments for the purchase of machinery or substantial equipment.

If you’re in the market for financing, particularly a $400,000 loan for equipment procurement, this alternative warrants careful evaluation.

Requirements: When considering equipment financing, having a solid personal credit history and a real commitment to engage in the procedure is crucial.

Merchant Cash Advance

Leveraging a business’s “merchant processing” setup, merchant cash advances handle credit card sales. Under this scheme, the business owner’s credit score and other criteria are less significant.

After receiving the funds, repayment happens automatically by taking a percentage of sales, eliminating the necessity for a set repayment plan.

Due to their elevated financing costs, these advances ought to be seen as a fallback option when the business owner has access to other financial avenues.

Requirements: A consistent monthly revenue from credit card transactions, preferably exceeding $10,000, is highly sought after. In this scenario, less-than-perfect credit is considered acceptable.

Cash Flow Financing

Recognizing the limitations inherent in merchant cash advances, Credit Suite presents an advantageous alternative called Cash Flow Financing. Similar to merchant cash advances, the primary requirement for this financial solution is the company’s cash flow.

However, Cash Flow Financing sets itself apart by not restricting qualification to businesses that rely solely on credit card sales for revenue. It considers all forms of cash inflow instead.

Requirements: Strong cash flow, at least $10,000 per month. Below average credit scores accepted.

Looking for another loan amount? Consider these articles: $900k Business Loan Options, $800k Business Loan Options, $700k Business Loan Options, $600k Business Loan Options, $500k Business Loan Options, $300k Business Loan Options, $250k Business Loan Options, $200k Business Loan Options, $150k Business Loan Options, and $100k Business Loan Options.